Introducing The Tally Protocol

a deep dive into the biggest Tally announcement yet

welcome back to the Tally newsletter, your weekly source for DAO governance insights in the Tally ecosystem. we’re tommy and ellie and this week we’re talking about Tally’s biggest announcement yet: The Tally Protocol.

✦ DEEP DIVE

This Newsletter aims to give a high level overview of how The Tally Protocol works and benefits DAOs. In order to thoroughly explain The Tally Protocol, it is helpful to explore the problems that DAOs face today and how the protocol solves these problems.

Last week Tally’s CEO and Co-Founder, Dennison Bertram posted a tweet thread announcing the Tally Protocol. You may have also seen this mirror post showcasing the protocol litepaper, and the commemorative zora mint of the protocol poster. If you haven’t checked these out yet, we highly recommend you do so now, you may even find an opportunity to win some Tally merch!

The Problem: DAO security is compromised by misaligned token incentives

Incentive mechanisms surrounding DAO tokens are currently broken. Token holders must decide between either participating in DAO governance or getting financial rewards through DeFi, exchanges, staking, etc. They cannot choose both.

This is extremely dangerous because token holders are financially incentivised to relinquish their governing power in favor of rewards. As more token holders do this, more voting power is locked in DeFi and centralized exchanges, and the DAO treasury becomes proportionally vulnerable to attack.

This dilemma is exacerbated by the rise of restaking platforms such as Eiganlayer and Symbiotic, because these platforms can always outbid DAOs by implementing token rewards. This means that the opportunity cost for token holders to maintain their governance rights is at an all time high, leaving DAO treasuries alarmingly vulnerable.

DAOs must return value to token holders to remain viable. Some of the largest DAOs today are exposed to governance attacks due to lack of participation. Uniswap has 158% of its quorum for sale in DeFi and on centralized exchanges, while the market cap of delegated ENS tokens is lower than the value of the accumulated treasury revenue. It is imperative that token holders are properly incentivized to maintain the security of the protocols they govern. (Source)

The Solution: Liquid Staked Governance

The Tally Protocol eliminates the choice between the governance and financial utility of DAO tokens and allows token holders to have both. Once live, token holders will be able to stake their DAO tokens in The Tally Protocol, delegate their votes, and receive a liquid staked governance token (Tally Liquid Staked Token or tLST) in return which can be used elsewhere for financial rewards.

Not only can token holders maintain the governing power and financial utility of their token through The Tally Protocol, but the protocol itself offers token holders rewards as well. tLSTs automate the process of generating yield for token holders by automatically claiming staking rewards and reinvesting them back into the staking contract. This enables growth of the underlying position without manual intervention. Holders benefit from convenience and maximized earning potential.

Benefits for DAOs

From the litepaper: [link]

DAOs struggle with setting security parameters, which affects their long-term safety and viability, especially when treasuries become honeypots for malicious actors. The increase in returned voting power allows the DAO to choose security parameters closer to outstanding token supply instead of outstanding delegated token supply.

Alignment with the underlying DAO is a critical component to Tally’s protocol design. In a world of competing LST standards, having a version explicitly aligned with the DAO significantly increases its adoption.

To ensure maximum alignment with the underlying DAO, the protocol:

- Activates undelegated voting power by redistributing it to active delegates according to strategies chosen by tLST holders. This increases governance participation and enhances DAO security. If underlying DAO token holders wish to change the redistribution strategy, they can move into the tLST and alter the redistribution strategies, ensuring that the underlying DAO is always in control.

- Creates a revenue stream for delegates that can be used to build feedback mechanisms for effective governance. This aligns delegates with the success of the tLST and encourages the DAO to endorse the tLST as their canonical solution.

- Empowers DAOs with control over the critical tLST parameters to align stakeholders with protocol and DAO success.

Looking Ahead

The Tally Protocol represents a significant step forward in the evolution of decentralized governance and the alignment of stakeholder interests within the DAO ecosystem. By providing a simple, accessible, and yield-generating staking mechanism through Tally Liquid Staked Tokens (tLSTs), the protocol offers a powerful solution for DAOs seeking to engage and incentivize their token holders while ensuring the long-term sustainability of their communities.

The protocol's modular design and open architecture creates a strong foundation for future growth and innovation. As the DAO landscape continues to mature and new staking designs emerge, the Tally Protocol is well-positioned to adapt and evolve, offering a flexible and robust infrastructure for a wide range of governance use cases.

Welcome to the future of decentralization.

☻ DAO TALK

Keep an eye out for a DAO Talk Interview with Tally CEO, Dennison Bertram dropping tomorrow!

❉ ONCHAIN PROPOSALS

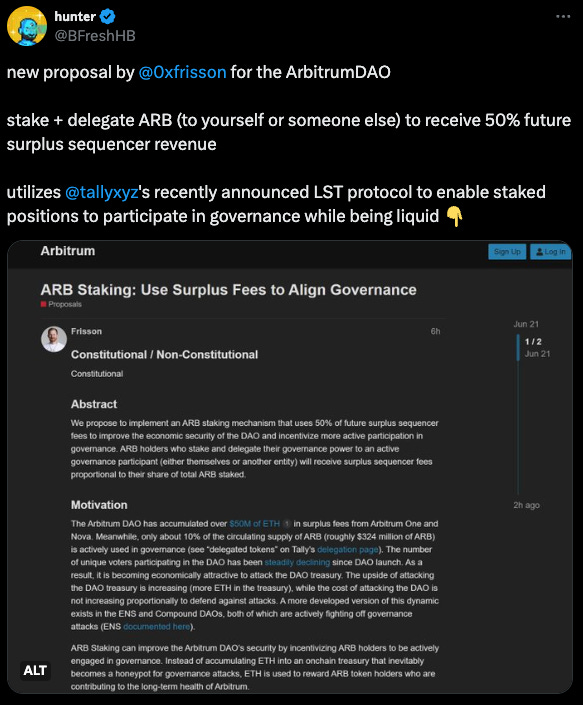

ARB Staking: Use Surplus Fees to Align Governance

“We propose to implement an ARB staking mechanism that uses 50% of future surplus sequencer fees to improve the economic security of the DAO and incentivize more active participation in governance. ARB holders who stake and delegate their governance power to an active governance participant (either themselves or another entity) will receive surplus sequencer fees proportional to their share of total ARB staked.”

https://x.com/BFreshHB/status/1804149236159623655