Non-Fungible Governance

The Tally Newsletter, Issue 74

Welcome back for issue 74 of the Tally Newsletter, a publication focused on defi and DAO governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

My name is 0xThanos, an NFT native and the newest member of Tally’s newsletter collective. I will provide deeper insights on NFT DAO’s and their takes on governance. As well as any NFT meta conversations that may affect governance.

In today’s issue, I will be doing an overview of why Non-Fungible governance is on track to become the dominant form of governance.

NFTs allow members to express varying levels of commitment to a DAO

In a fungible world, the difference of the commitment to the DAO between users is not noticeable. For example, if you make a 100 ETH commitment to the DAO - the only way to participate is to buy 100 ETH of the tokens.

In contrast, NFTs allow members to express levels of confidence in the DAO. There's a difference between sweeping the floor and buying an expensive piece from the collection. When a whale buys a rare piece in the collection, they are signaling long-term belief - generally, these are not great assets to flip due to illiquidity.

Alternatively, a whale can sweep the floor - thus accumulating more governance for the 100 ETH. NounsDAO has a famous slogan "1 Noun = 1 Vote" implying that all nouns are the same voting power. That being said, certain rarer traits command premiums. Bharat's famous skull noun went for a whopping 215 ETH amount even though the governance power is the same as the Noun that went for 100 ETH before it. Bharat is not buying that specific Noun because he cares about the governance weight, but rather because it is his forever Noun.

Holders of a project can sniff out what is a governance power grab or flip by viewing the NFT and its associated traits. As Deeze would say:

Illiquidity forms a higher barrier to exit

Fungible tokens are positions that can be levered up as easily as they can be levered down. A holder can easily buy partial positions or join with minimal buy-in friction. Thanks to AMMs, there is always enough liquidity to exit without too much slippage. I have heard from some fungible token DAO operators that they have to tailor to the needs of whales who threaten to dump.

Alternatively, NFTs have a much higher difficulty threshold to enter and exit. To join the NFT DAO, at worst, you must buy the floor. To leave the respective NFT DAO, the NFT must be dumped on whatever minimal liquidity there is. In NFT land, we rely on thin centralized off-chain order books, which makes it difficult for an NFT whale to dump without wrecking themselves. On an AMM, LPs have staked their assets to earn yield thus, liquidity is always there.

Disclaimer: I know you hardos will point to Sudoswap’s recent launch as an NFT AMM. Still waiting on more data and will touch on that in a later newsletter issue. Point is, that liquidity is still not as easily sourced with NFTs.

NFTs bring identity to DAO participants

When is the last time you saw “I own 100k $FWB” as someone’s PFP on Twitter?

This one seems obvious for one-off PFP projects, but it has downstream implications when the PFP is part of a DAO. When the NFT DAO becomes an identity, it aligns the DAO participant with the success of the DAO. The DAO is the identity of the person.

Rare jpeg believers are easily viewable in public, and DAO participants can see who is who, whether on Twitter or on-chain. An ERC20 token has no unique way of attaching itself to a specific person. When you build a following on Twitter or on-chain using the PFP of an ape or punk, people recognize you as that. "Oh Deeze! He's the slick hoodie, 3D glasses punk!" "Isn't Soby the one with the Murakami Clone?” Pivoting from a PFP you are known for publicly is difficult and can often lead to a loss in engagement and identity.

The more group identity that is enabled by the DAO’s NFTs, the more commitment there will be to its success. An example in the traditional realm would be like holding equity v. working at the company and wearing the swag. You work at a company but can not display that you work at that company. Enthusiasm for being part of the group builds community and belonging to the members of it.

NounsDAO enables this NFT identity beyond social signaling on social media. The DAO makes the identity interactive when voting in proposals. You can see who's who and which way they voted; a visual representation vs deciphering alphanumerics. When a Noun votes on the proposal, an icon of the Noun and the associated ENS is shown. A subtle yet fun and interactive way of voting on proposals.

As you can see above evets.eth, voted against the JokeDAO proposal. It’s easily viewable and tied to the owner’s identity.

“For the owner of the NFT to form a bond with that thing (their Noun) as their digital identity in that organization… that is responsible for a significant amount of the engagement.” - 4156 on I Pledge Allegiance

NFT chain abstraction is miles ahead

NFTs enable the ability to track a specific token through its history. Yes, you can track fungible token transfers on-chain, but they are not in plain sight. I have to dig through Etherscan then calculate the value at the time of purchase/transfer or dig through actions to track which way they voted on proposals. Not only can I view the actions of NFTs easier, but I know the attributes and rarity of the NFT by simply hopping onto any NFT exchange. Again, NounsDAO nailed the abstraction; take a look.

“This Non-Fungible character is an atomic unit that you can track through its history.” - 4156 on I Pledge Allegiance

The point of building on-chain primitives is having the ability to see clearly what others are doing. Data aggregators like Nansen have mastered the ability to view on-chain data seamlessly, yet NFT projects themselves have not. On-chain history of a token voting in proposals will be a must-have aspect for NFT DAOs of the future.

Cobie’s Comment

Cobie's comment caused a stir this week on CT. NFT collectors took offense to Cobie calling NFTs “altcoins with pictures.” Is Cobie on par with his statement? I would agree with Cobie.

More of what Cobie is implying is that 99% of NFT projects are likely 0's, similar to those of the 2017 ICO run. ERC 721's are functionally simply a token that points to an image stored on IPFS (occasionally on-chain).

The remaining distinction is that NFTs trade as whole tokens instead of tokens that can not be split. Whole token trading can be abstracted away in layers. Fractional (now Tessera) has made a business "fractionalizing" NFTs. Fractionalization has led to sub-DAOs. Boba the bean farmer is a sub-DAO that controls 1 vote. Lil Nouns could also be perceived as a sub DAO of NounsDAO that controls 6 NounsDAO votes.

I understand where Cobie is coming from, but I believe there are inherent benefits as listed in this newsletter to NFTs. NFT DAOs specifically are relatively newer, and I expect many more implementations and flavors to follow.

Final Remarks

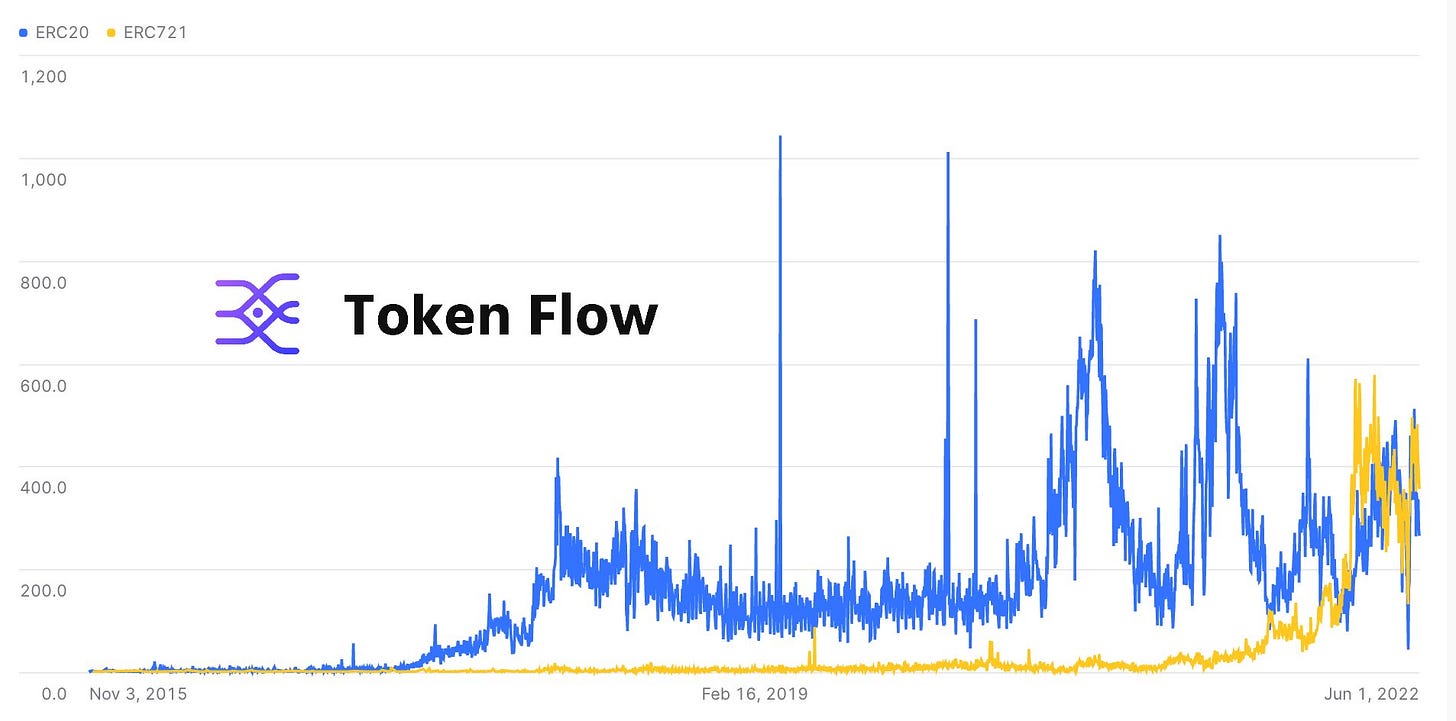

ERC721 transfers have now surpassed ERC20 transfers signaling growing adoption; I suspect this is the beginning of a trend that will continue.

Also, the amount of ERC721 contracts deployed is nearly step-for-step with ERC20 contracts. Prior to 2021, ERC20 was a clear leader in contracts deployed.

DAOs have been floating around well before NFTs were mass adopted within the space, which left NFT DAOs under-explored. NounsDAO is a pioneer for NFT DAOs. Considering their open source focus, I believe the NounsDAO structure will inspire many future NFT DAO experiments.

In my next edition, I will explore how projects can leverage existing NounsDAO infrastructure to launch. Steady lads.

Thank you Derek, Luke, Frisson, and Sourabh for providing feedback!