Sudoswap & The Impending NFT Royalty Crisis

...

Welcome back for issue 75 of the Tally Newsletter, a publication focused on DeFi and DAO governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

My name is 0xThanos, an NFT native and the newest member of Tally’s newsletter collective. I will provide deeper insights on NFT DAO’s and their takes on governance. As well as any NFT meta conversations that may affect governance.

In today’s issue, we will dive into Sudoswap’s AMM ascent and how it alters NFT DAO’s revenue generation.

Intro

gm, anon. There’s been a buzz about Sudoswap’s recent ascent. Sudoswap is not another Opensea exchange clone; it is materially different and has opened up a pandora’s box about the enforceability of NFT royalties that has downstream effects on NFT DAOs. What does a world with zero NFT royalties look like?

Sudoswap Primer

Sudoswap was launched as a P2P asset trading exchange. You define which assets you would like to trade and a counterparty you would like to trade with. When trading P2P you do not pay royalties. In perspective, this was a small part of the NFT trading market share.

Sudoswap’s AMM entered the scene with a bang. People have long dreamed of NFT AMMs because they theoretically provide better liquidity and allow for on-chain trading. Unisocks was an early attempt, but then the space trended towards centralized off-chain order books as a means of more effective pricing.

Historically, AMMs have been difficult to implement for NFTs. Generally, LP’ing a pool is straightforward - deposit assets on both sides of the pool and earn trading commissions. With NFTs, every asset is quite literally non-fungible; therefore, NFT AMMs can’t use traditional Uniswap-like bonding curves.

How does Sudoswap work?

Sudoswap operates a bit differently from regular AMMs. There are three different types of pools: sell only, buy only, and both buy-and-sell. Each pool on Sudoswap is defined by the user who creates it. All the pools are then aggregated to allow people to trade in and out.

Let’s take a look at an example buy-and-sell pool.

As you can see, the pool creator has submitted .18 ETH and 11 Zorbs. They commit to buying Zorbs at .02517 (decreasing by .002 with each Zorb bought) and selling zorbs at .02797 (increasing by .002 for each Zorb sold). The pool creator is asking for a 1% swap fee on top of the 0.5% Sudoswap charges. Note that each pool creator can define the swap fees they collect, and no royalties are paid to the project creators.

Buy-only or sell-only pools operate similarly. The pool creator defines the price, delta, and swap fee for each buy or sale in their pool.

Sudoswap Growth

Sudoswap’s growth is clear in the numbers. Daily active user growth has skyrocketed this month.

The number of pools, which represents liquidity on the platform, is also growing.

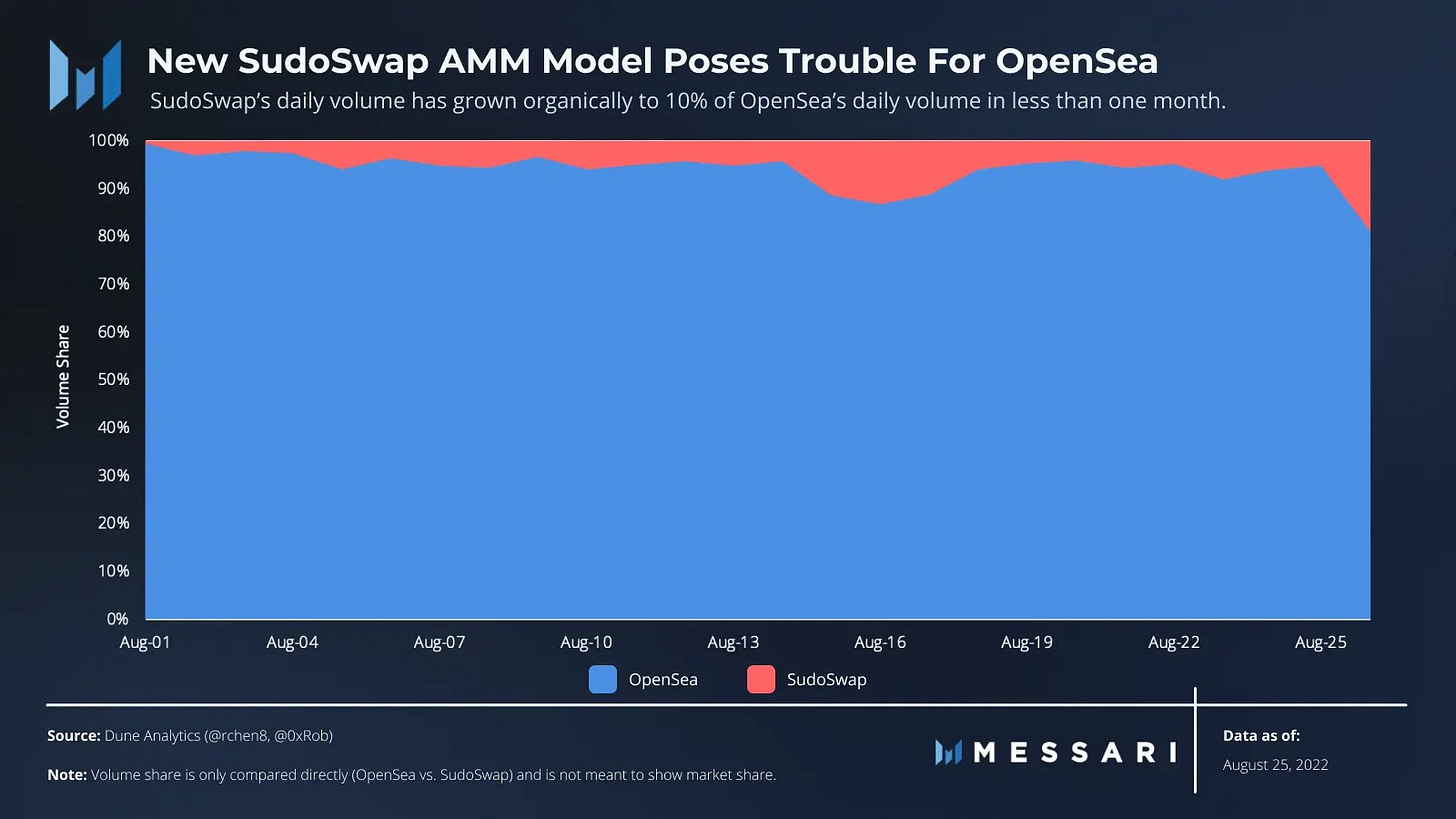

Sudoswap has steadily eaten into Opensea’s market share and is now doing close to 10% of Opensea’s volume.

Now that we’ve established Sudoswap as an AMM with real volume, let’s look at the top traded NFT collections.

What you will notice is that top-tier NFT PFP collections that rely on royalties make an appearance here. Azuki, CloneX, MAYC, and Moonbirds rely on secondary market sale royalty collection to bootstrap their DAOs or specific company operations.

NFT Royalties

Royalty collection is what has attracted artists to NFTs. In traditional art markets, artists only revenue on the original sale of their art. Zora dives deeper into what they call The Yeezy Problem.

Royalty capture on secondary sales has been paradigm-shifting for traditional artists. But, it turns out that royalty capture is not enforceable at the smart contract layer. Rather, the royalties buyers are paying are social consensus defined by a project and then enforced by the marketplace (ie Opensea, LooksRare).

Regardless of how you try to enforce the royalties of the ERC721, you can always wrap, transfer, and unwrap to avoid paying the royalties… yikes. With Sudoswap already eating up market share in the NFT marketplace landscape, Opensea and LooksRare will have to consider their royalty approaches. Do they stay as is? Do they make them optional? Do they allow creators to decide? Fee compression has already begun in the NFT space. As Opensea loses market share, they will act accordingly to regain it.

Historically, exchange fees are a rat race to 0. Robinhood forcing every equity broker to offer 0 commission trading is a prime example. This is also happening with crypto exchanges. Particularly exchanges like Binance and Strike have already moved to commisionless bitcoin trading. You pay for it with looser spreads, but that’s beyond the point - it’s all a race to 0.

What makes NFTs different is the fee structure is mixed; there is an exchange fee and a royalty payment to the creators. To retain volumes, you would have to imagine marketplaces purge royalty payments first.

DAOnstream Effects

Not being able to collect royalties will shock business models that rely on secondary royalty capture. The NFT standard is launching a 10k collection and then growing the DAO via initial mint proceeds and secondary royalty collection. Once marketplaces converge on not paying royalties, this drop mechanic is effectively rendered useless. NFT DAOs and companies will have to find another way to monetize. There are two paths out: LP part of your drop or auction NounsDAO style.

If a project decides to LP the drop, they must keep part of the mint to create pools on Sudoswap. The project creators can then capture swap fees from the pools they create to generate revnue. This alternative way to generate revenue instead of charging royalties on secondary sales.

On the other hand, NFT projects can launch NounsDAO style, which would bootstrap revenues in perpetuity. By auctioning a mint every day (or in whatever intervals the project defines), the project will forever drive revenue to its DAO, thus avoiding reliance on secondary royalties.

Final Remarks

The irony of the Sudoswap AMM launch is that they very easily could have enforced royalties on their swaps. Deciding not to charge royalties caused a stir, resulting in free visibility for Sudoswap’s AMM. The NFT royalty conversation was CT’s most heated debate for weeks.

Crypto is accelerationist technology. If royalties don’t have to be paid by traders, they won’t pay them. Why pay the tax when it’s voluntary? NFT volume has been down across the board, but I expect this debate to resurface when volume returns post-merge.

LP’ing the drop or minting via NounsDAO style is a formula for new projects; I’m curious to see how existing NFT projects handle the impending royalty crisis. Steady lads, the merge is coming.