The Tally Newsletter, Issue 12

December 29, 2020

Welcome back for this year’s final issue of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week, we cover:

1inch token launches with “instant governance”

Gemini seeks support for Aave listing

MakerDAO peg stability module goes live

Compound contributors enable gasless voting

Cover protocol exploited

Yam Finance removes rebase

1Inch Exchange Launches Governance Token

TL;DR: So called “instant governance” grants token holders control over key parameters, including referral fees paid to the 1inch core team itself.

The 1inch team surprised the defi ecosystem with an early present this year, releasing their token on Christmas eve with an airdrop to past users.

Compared with the previous Uniswap token distribution, the 1inch drop gave generally higher rewards to a smaller cohort of users. This makes sense as 1inch appeals to large traders whose ticket sizes justify the additional gas cost of using an aggregator.

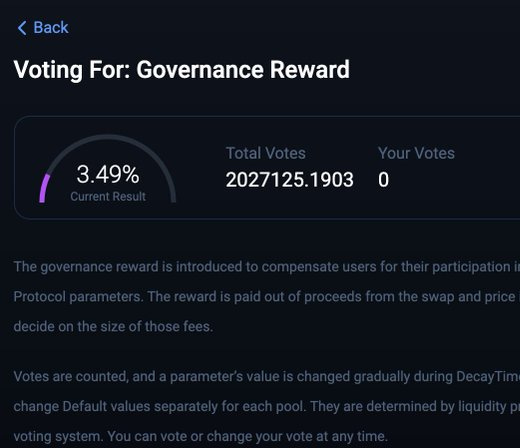

One of the most interesting elements of the 1inch token is the “instant governance” mechanisms that allow token holders to quickly adjust system parameters. Votes are re-run continuously, and take effect gradually during a 24 hour delay period.

The system also makes use of conviction voting, as voters can choose from a range of values for each variable. Those unhappy with the current outcome of a vote would select a value on either end of the range to give their vote the highest possible impact.

While instant governance offers interesting utility to the 1inch token and ecosystem, it may also lead to shortsighted governance decisions. Since the token’s release, we’ve already seen cases of protocol fees and rent extraction being increased, without a clear discussion of the impacts.

There was also an incident where referral fees were vastly increased, which redirects funds from governance to the 1inch team. Given the concentration of token ownership among insiders, it may be possible to extract protocol revenues through referral mechanisms and bypass minority holders in governance.

All liquidity pools supported with 1inch’s initial liquidity mining rewards include the 1inch token itself. Granting 100% of rewards to “pool 2” is a fairly unorthodox distribution strategy, as it incentivizes pairs without natural demand for liquidity.

Gemini Prepares for Listing GUSD on Aave

TL;DR: The Gemini team is gathering proposal power to make GUSD the second asset added through Aave v2 governance.

It’s been less than a week since Aave’s first v2 governance proposal, and a new listing is already brewing. In last week’s issue, we covered the autonomous listing proposal for Curve Finance’s CRV token, which was the first to make use of Aave’s separate proposal power delegation.

The Gemini team is following close behind, with Tyler Winklevoss making a pitch for vote delegations yesterday in support of adding GUSD.

Aave’s core risk team completed an evaluation of the asset, recommending against using GUSD as collateral and suggesting similar parameters to BUSD. This aligns Aave with MakerDAO in building professional risk management functions. But in Aave’s case, they have not yet developed a governance framework (like MakerDAO’s MIPs) to specifically recognize the risk team’s input on listing proposals and parameters.

With sufficient proposal power in hand, the GUSD listing proposal was submitted earlier this morning, and the vote will be live for the next 3 days. The community can expect additional follow on proposals soon, with Sushiswap’s 0xMaki already expressing interest in SUSHI and xSUSHI listings.

Maker Community Ships the Peg Stability Module

TL;DR: The PSM was built despite lack of input from the Maker Foundation, showing the potential for community led initiatives.

After months of suspense, MakerDAO has finally delivered the peg stability module. The PSM is meant to replace existing stablecoin vaults and provide a better user experience to DAI holders and vaults. Users will be able to swap supported stablecoins (currently only USDC) into and out of DAI for a flat fee, working like a constant sum market maker similar to mStable.

The PSM has been deployed for USDC with an initial 3 million DAI issuance limit, but this will be expanded over time as the community gains confidence in the underlying system.

The deployment caps off a tumultuous period of adjustment since the PSM was initially proposed over the summer. While the Maker Foundation had planned on implementing it on behalf of the community, legal considerations forced them to back away abruptly in late July. Even as recently as this month, the Foundation was struggling with how to work on executive spells without supporting the PSM initiative. Luckily, Maker community member Hexonaut had the necessary technical chops to implement and execute the proposal without assistance.

The PSM may serve as the first operating expense funded by the community. An audit firm has been hired to review the code, with the expectation of payment from MakerDAO governance after the fact - now it’s just up to MakerDAO voters to follow through.

Compound Enables Gasless Voting

TL;DR: Compound’s tool enables voting and delegation via signed messages, allowing the protocol to subsidize transaction costs to boost governance participation.

Community members Arr00 and Anish Agnihotri have just released comp.vote, a simple interface that allows Compound to pay voting and delegation gas costs on behalf of token holders.

Users sign messages with their wallet to vote or delegate without gas costs. The system will periodically relay these signed transactions, with transaction fees paid on users’ behalf (currently through grant funds, but potentially paid by the protocol in the future).

With both transaction fees and the ETH price increasing markedly this year, gas has become a key scalability challenge for governance systems. Snapshot flourished by allowing users to participate cheaply and easily, but the security tradeoffs of off chain voting may not be appropriate for high value governance matters. Comp.vote is an alternative approach that helps alleviate friction without compromising security.

Cover Protocol Exploited in Minting Attack

TL;DR: A technical flaw allowed attackers to mint unlimited COVER tokens and capture liquidity from AMM pools.

Cover Protocol was hit with a devastating exploit yesterday. While the core protocol was unaffected, a flaw in the liquidity mining contract allowed for infinitely minting COVER tokens in certain cases. This allowed the exploiters to withdraw all funds from AMM exchange pools that included the COVER token.

Quick action by Powerpool’s core team may have saved the YETI index from huge losses, as trading was deactivated before users could dump COVER tokens and withdraw all other liquidity. PieDAO’s Yearn ecosystem thematic index was unaffected, as it does not hold funds in AMM pools.

By a stroke of luck, a portion of AMM funds were saved by the dev of Grap Finance, a food coin from the August farming era. They were able to reproduce the exploit and return over $3 million worth of ETH to the Cover Protocol multisig.

The Cover team has released a post mortem report on the incident, and is planning to issue a replacement COVER token based on a Snapshot from before the exploit. While this is a fairly standard recovery mechanism for large scale hacks (several tokens did this during the KuCoin hack from earlier this fall), not everyone is pleased.

As defi protocols are unincorporated entities, individual contributors may face legal risk from their actions in governance. The Cover debacle could show if remaining pseudonymous gives contributors sufficient protection from legal action.

Yam Finance Votes to End Supply Rebase

TL;DR: Protocol funding will transition from rebasing with taxation to an inflation based issuance model.

Yam Finance’s launch in August brought on the short lived food coin era. The protocol was able to build up a sizable treasury for future development through a rebase mechanism similar to Ampleforth - when the price of YAM is over $1, additional tokens are minted, with 90% given to existing holders pro rata, and the remaining 10% sold to acquire assets for the governance treasury.

While this helped YAM bootstrap initial funding and gain mindshare, rebasing mechanics have fallen out of favor among investors during the ensuing months. In YAM’s case, there was also an issue of inefficiency, as the protocol was forced to incentivize AMM liquidity to facilitate selling tokens from the treasury.

The community aligned around an alternative token economic mechanism based on fixed inflation. This will help maintain adequate operational funding in varied environments, reducing reliance on short term price spikes to raise money. Removing the rebase also helps focus attention on Yam’s core products, including a forthcoming insurance protocol and a synthetic asset platform built on UMA.

Thanks for joining us for this week’s Tally Newsletter! Be sure to check out the Tally governance app, and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally