The Tally Newsletter, Issue 17

Welcome back for issue 17 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week, we cover:

Balancer teases v2 exchange features

Compound considers increasing WBTC borrowing power

Plus, brief updates from around the ecosystem!

Balancer Announces Forthcoming v2

TL;DR: Balancer v2 will offer greater gas efficiency, and also enable pool managers to lend funds and participate in metagovernance.

Balancer Exchange offers a flexible AMM framework, permitting up to 8 separate assets per pool with custom weights and trading fees set by the pool creator. These unique features have made Balancer a key player in defi over the past year, with Balancer pools frequently used for index fund management, new token listings, and liquidity incentive programs.

But while Balancer offers features that other AMMs such as Uniswap and Sushiswap can’t, it also has some severe drawbacks that have hindered adoption. First and foremost, as the price of ETH and gas fees have ballooned this year, it has become ever more expensive for users to trade on Balancer.

Last week, BAL governance voted to begin reimbursing gas expenses for certain trades made through the Balancer front end. But this is just intended as a stopgap solution to support usability until Balancer v2 goes live.

V2 will bring several improvements in efficiency that should help Balancer capture more retail trading volume.

In contrast to existing AMM implementation, where funds for each liquidity pool are held within separate contracts, Balancer will hold all liquidity together in a single protocol vault and record individual pool balances virtually. This will reduce friction for trades flowing through more than one pool, as any intermediate trades between pools don’t require a token transfer.

Trades can make use of virtual balances as well, either receiving delivery of the output asset (and paying gas for the accompanying token transfer) or leaving the output liquidity on the exchange as a virtual balance for future trades.

Balancer v2 includes features that can vastly improve capital efficiency. Specially designed pools can delegate authority to a manager contract, which can then remove some of the pools liquidity to be used in external defi applications. Much of the liquidity within AMM pools only gets utilized at extreme ends of the price spectrum, so managers could safely supply a portion of pool funds to lending protocols or use for metagovernance while maintaining sufficient trading liquidity.

While Balancer v2 offers a lot of potential to traders and liquidity providers, it also offers the first opportunity for the BAL token to begin capturing value from the ecosystem. V2 enables protocol fees for trades, LP withdrawals, and flash loans, with values to be determined through the governance process after launch.

Compound Considers WBTC Proposal

TL;DR: Proposal 36 would raise WBTC’s borrowing power from 60%-75% of asset value.

While Compound was one of the first lending protocols to support WBTC, lately it has begun to fall behind competitors offering more favorable terms. For example, MakerDAO offers WBTC backed loans for up to 66% of collateral value, and Aave offers loan amounts up to 75% of collateral value.

WBTC liquidity has improved markedly through the second half of 2020, largely as a result of generous incentives offered to decentralized exchange liquidity providers. But despite improving market conditions, no action has been taken to adjust WBTC risk parameters since the collateral factor was raised from 40% to 60% in October.

With Compound now lagging far behind other defi lenders, community member Getty Hill organized a community autonomous proposal to close the gap.

Proposal 36 will increase WBTC borrowing power from 60 to 75% of collateral value, putting it back on par with the competition. While the proposal has received fairly broad support so far, a somewhat inexplicable mishap is upstaging the final day of voting.

Source: withtally.com

Gauntlet Network, one of the largest COMP voting delegates, promptly voted in favor of the proposal when it was first submitted. But a day later, they released a statement coming out against the proposal due to potential insolvency risk for the protocol.

While this is a sensible reason to oppose a proposal, their explanation of the initial yes vote is implausible to say the least.

While the proposal has already met the minimum quorum requirement and is on track to pass, Gauntlet has hinted at a future proposal to adjust all assets’ collateral factors, so any increase in WBTC borrowing power may be short lived.

In Brief:

Yearn passes proposal to mint 6,666 additional YFI:

Curve considers raising liquidity amplification parameter in response to MakerDAO’s peg stability module:

Alameda Research acquires Ren development talent:

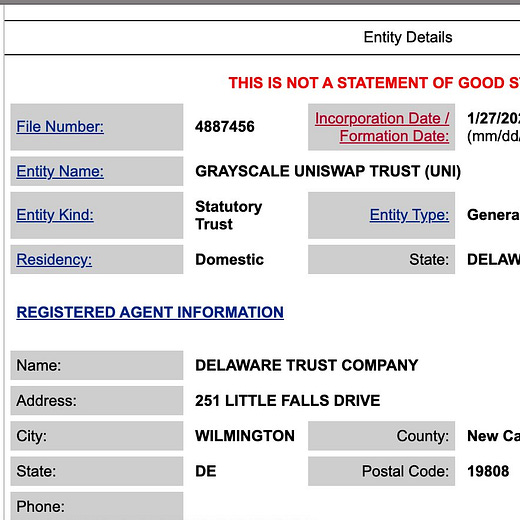

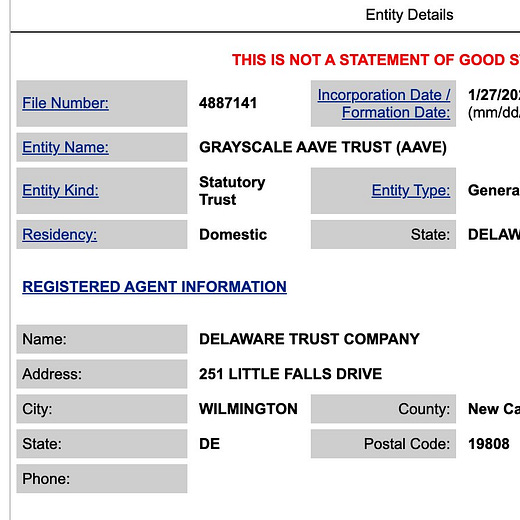

Investment firm Grayscale potentially setting up trusts for UNI and AAVE:

Whale wallet 0xB1 proposes revised compensation plan for Compound DAI users:

Synthetix Spartan Council freezes trading in sXAG synthetic silver amid meme fueled rally:

Aave votes to add BAL token:

Cream Finance adding support for Uniswap and Sushiswap LP tokens:

Alpha Finance launches Homora v2, supporting additional assets and LPs:

Thanks for joining us for this week’s Tally Newsletter! Be sure to check out the Tally governance app, and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally