The Tally Newsletter, Issue 21

March 3, 2021

Welcome back for issue 21 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover:

Gauntlet submits Compound proposal 39 for risk parameter adjustments

Inverse Finance votes to enable token transfers

Plus a roundup of key proposals and protocol news from the last week!

Gauntlet Network’s Compound Proposal 39 is Live

TL;DR: The proposal would reduce WBTC borrowing power, while also bundling in adjustments to the BAT and ZRX markets that failed to meet quorum requirements in proposal 38.

Following the surprise failure of proposal 38 last week, Gauntlet has returned to the governance arena with another batch of parameter adjustments.

The new proposal makes adjustments to the collateral factor (the maximum permitted ratio of borrowed value to collateral value) for three of Compound’s assets, changing the parameter for the BAT, ZRX and WBTC markets to 65%. While this represents a modest increase in borrowing power for BAT and ZRX, WBTC will see its leverage curtailed.

This presents a challenge, as some existing WBTC backed borrowing positions may be forced into immediate liquidation upon passage of this proposal. Compound delegate Getty Hill echoed this concern, while also noting that WBTC’s liquidity characteristics are tougher to model due to the ability to redeem for native BTC. Looking only at direct trading in WBTC, without considering redemption capacity through WBTC merchants (authorized to redeem for WBTC to BTC for KYC’ed individuals) or the renBTC bridge, may underestimate the capacity available for liquidations.

On the other hand, Compound’s oracle implementation uses Coinbase BTC price to judge WBTC borrowing positions’ collateral, which could present severe risk to the protocol if WBTC ever trades at a substantial discount. Liquidation bots are only offered an 8% discount to the oracle price of collateral, so they would be unwilling to liquidate unsafe positions if the discount of WBTC to BTC price exceeded this threshold (offered price for WBTC collateral would be above the market price, eliminating profit opportunity).

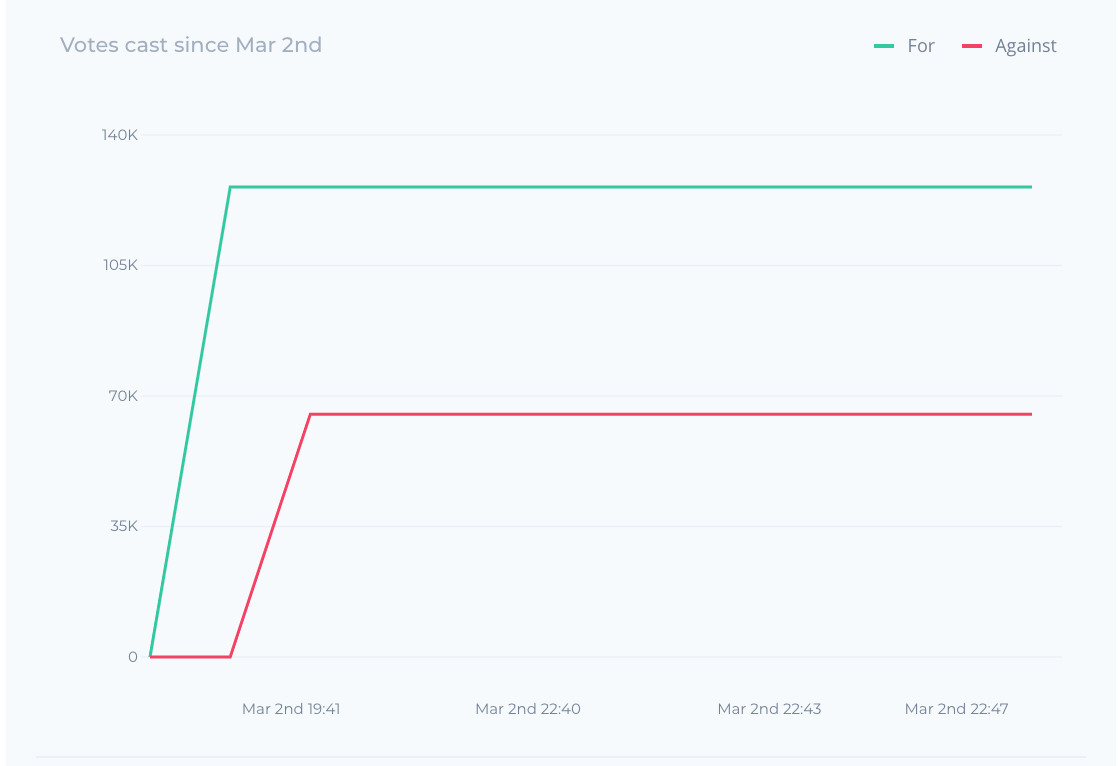

Chart: Compound proposal 39 voting history, withtally.com

Voting is currently closely divided, with Getty (sponsor of proposal 36 that recently raised WBTC collateral factor) opposing the proposal with 65,000 COMP voting power.

While Gauntlet enjoys broad support and confidence from the Compound community, the closed source nature of their analysis and simulations makes it tough for them to explain the urgency of risk parameter changes; generally they provide ratings and suggested parameter changes without disclosing their methodology. This time around, they made a point of providing additional context on their model inputs as compared with their previous parameter update, and the vote’s outcome may help set a precedent for the level of transparency expected of future proposals.

Inverse Finance Vote Enables Token Transfers

TL;DR: The closely contested proposal allows for INV transfers and trading beginning on Thursday, while also eliminating the seizure mechanism used to weed out inactive members.

Inverse Finance is an upstart defi protocol launched in December. Their flagship product is a unique vault mechanism that allows users to automatically reinvest yield earned on one asset into another target asset; for example, users can deposit a USD stablecoin such as DAI, with yield earned passively invested into ETH.

This is similar to a dollar cost averaging strategy where assets are purchased at a steady rate over time, reducing the risk of buying in at a market top.

In addition to novel product offerings, Inverse Finance has also espoused unique governance mechanisms and philosophies. The initial distribution of INV governance tokens was arranged via a sign up airdrop (reminiscent of the “Don’t Buy Meme” distribution in August of 2020). But the tokens themselves were non transferable (therefore unable to be sold and truly “valueless”), and governance had the ability to claw back stakes from idle DAO members. This clawback mechanism was used in no less than three governance proposals (proposals 1, 6, and 7) to ensure only active contributors would retain voting power.

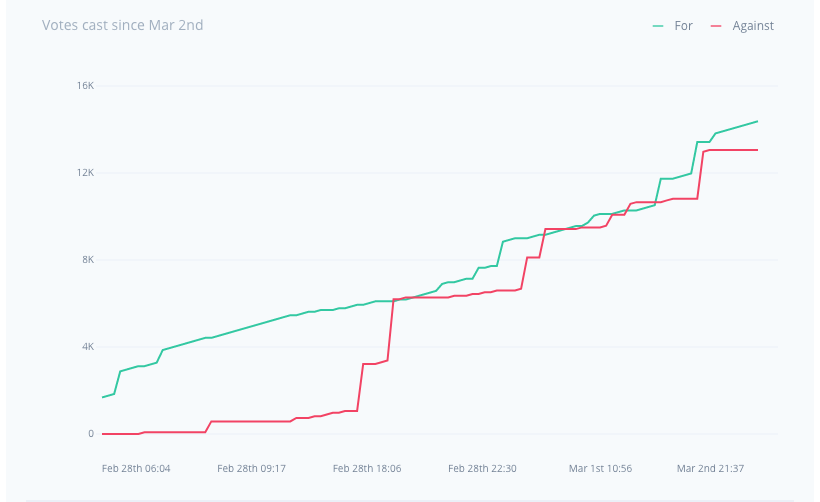

Chart: Inverse Finance proposal 3 (first attempt) voting history, withtally.com

A previous attempt to remove these token restrictions was soundly defeated, but with governance and products now stabilized a new vote was proposed to activate transferability and remove the clawback functions. Sentiment on proposal 10 was fairly evenly divided, with for and against sides passing off the lead several times by the end of the proposal.

Chart: Inverse Finance proposal 10 (second attempt) voting history, withtally.com

The DAO’s strategy of removing inactive voters also seems to have paid off, with an extremely high participation rate despite the impending removal of token seizure functions. And with the proposal now passed successfully, INV tokens will become transferable after the conclusion of the 48 hour governance timelock delay. This will give Inverse DAO the opportunity to onboard new members and reward early voters for their participation.

In Brief:

Pool Together votes on first governance proposal, to reduce POOL token distribution speed:

Furucombo experiences token approval exploit, user wallets drained:

Compound community discusses funding grants program:

Reflexer Labs share details on FLX, future “ungovernance” token of RAI protocol:

PieDAO’s DEFI+L index migrates to vault implementation that supports yield and meta-governance:

Nexus Mutual community fund goes live:

Idle Finance holds snapshot voting to approve B2B referral program:

Indexed Finance launches new fund for up and coming mid/low cap tokens:

Alchemix leverage platform draws in over 100 million DAI shortly after launch, forcing unscheduled MakerDAO vote:

Thanks for joining us for issue 21 of the Tally Newsletter! Be sure to check out the Tally governance app, and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally