The Tally Newsletter, Issue 23

March 17, 2021

The Tally Newsletter, Issue 23

Welcome back for issue 23 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover:

Compound’s successful proposal 41 begins WBTC market migration

Gnosis announces integration for executing Snapshot votes through multisigs

Plus brief updates on ecosystem news and active votes!

Compound Proposal 41 Passes

TL;DR: The proposal creates a second WBTC market based on the new cToken framework, and moves COMP rewards to incentivize migration.

When Compound launched its original cToken markets, the concept of algorithmically set interest rates was relatively new. With a lack of empirical evidence on the optimal rate curve, simple linear rate versus utilization formulas were used to balance supply and demand for funds.

These linear rate curves are still in use today for several markets, including the WBTC market shown above which was the target of proposal 41’s update.

The primary purpose of basing interest rates on utilization is to ensure that depositors always have liquidity available to withdraw their assets. If 100% of funds in a market are being actively borrowed, depositors are stuck in the market and can’t withdraw until liquidity is added or loans are repaid. This can be problematic, as many depositors also borrow funds against the value of their assets, and need to be able to withdraw and sell their collateral in a downturn to avoid liquidation.

Linear rate curves do a decent job of incentivizing liquidity, but the newer “jump” interest rate models arguably offer more safety while improving market efficiency. The new rate models include a “kink” point (currently set at 80% utilization) where borrowing rates begin to increase more rapidly. This allows for setting an extremely high terminal interest rate that ensures markets are never fully utilized. On the other hand, the interest rate at the kink point can be set low enough to support borrowing demand, which in turn improves depositor returns.

While the newer generation of cToken contracts can be modified by governance, the old cTokens predated governance and were non-upgradable as a safeguard against centralization risk. This limits the protocol’s ability to respond to changing market conditions with rate upgrades, as was necessary to curb UNI borrowing demand with proposal 26, and also complicates the upgrade process.

Compound’s upgrade will be taking place in a few key steps. First, proposal 41 will create a new WBTC market and move COMP token incentives, while leaving the old market operating as normal. Once users have migrated the bulk of their positions, proposals will be created to safely disable and deprecate the old market. This process will also need to be repeated for other legacy markets including ZRX, BAT, and ETH.

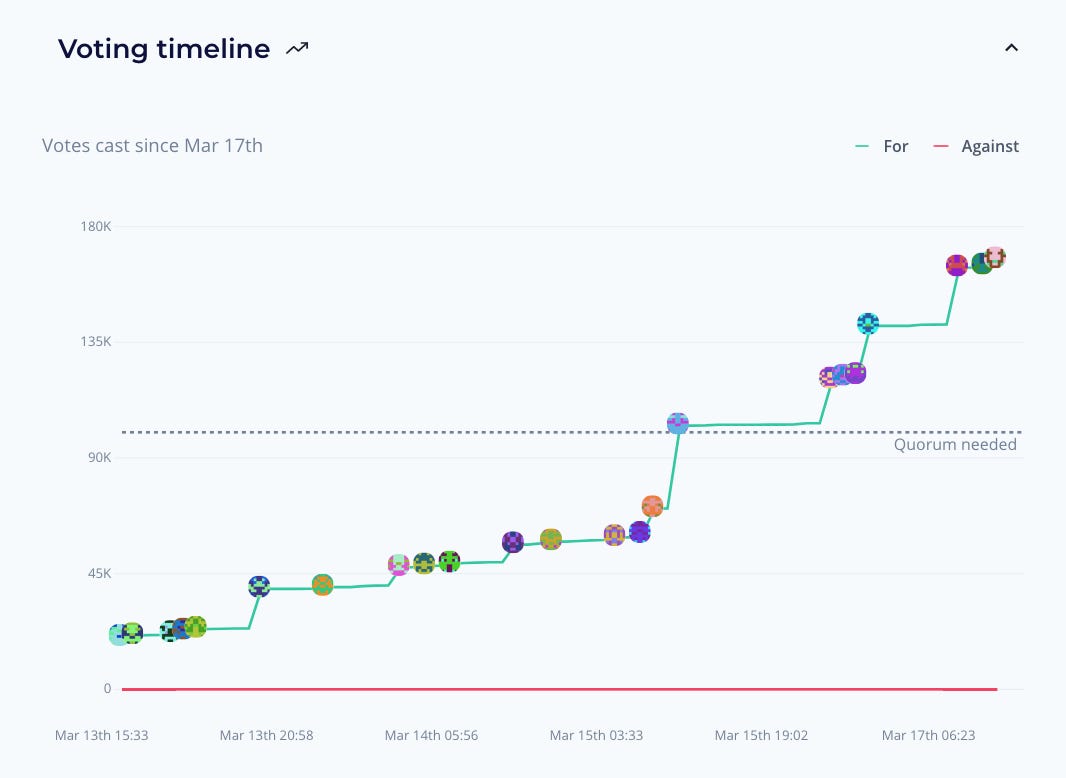

Source: withtally.com/governance/compound/proposal/41

While the change had broad consensus among voters, student group and delegate Cal Blockchain raised some concerns about user support for the migration. Currently there’s no migration app in place to enable transferring positions to the new market (for example by using flash loans), which could complicate users ability to move positions and continue earning COMP. With more market migrations planned in the near future, this could be a potentially valuable use for funding from Compound’s new grants program.

Gnosis Safe Launches Module to Empower Snapshot Voting

TL;DR: The Safe Snap module will allow for on chain execution of snapshot votes, secured by a challenge bond mechanism and arbitration oracle.

Snapshot voting has become widespread among defi protocols since it was launched last summer. But while it has provided huge benefits to participation by enabling voting without transaction fees, it requires significant compromises on decentralization.

Snapshot records votes as signed messages off chain, which reduces user friction but also makes it impossible for votes to directly execute proposals (as is the case with Compound’s Governor Alpha framework or other on chain governance). The typical solution is to grant execution authority to a multisig or core team, but this presents centralization risk to the protocol as well as potential liability for multisig signers.

Gnosis recently released the first attempt to bridge the gap between off chain voting and on chain execution, with their Safe Snap module.

Safe Snap plugs into existing multisigs, and creates a method for off chain vote results to impact multisig assets and admin privileges. After a vote is held via Snapshot, users can post a bond of governance tokens via Reality.eth (another Gnosis product focused on prediction markets) to execute the proposal results. If the proposed outcome is not correct, other users can post a challenge bond of greater amounts to halt execution. This challenge game can continue escalating until one side is unable or unwilling to post additional bonds.

While this is very similar to the proposed Aragon integration for executing Snapshot votes, Aragon uses the ANT token as the final source of security to arbitrate on disputes that exceed a maximum bond amount. This can present governance risk for high value protocols, as it may be cheaper to stage an attack through capturing the ANT token versus the target protocol’s governance token. The Safe Snap module allows for denominating bonds in the protocols’ own token which ensures security scales with protocol value.

This service is still in early stages of adoption, but already Yearn, Sushiswap, Balancer and others have expressed interest in integrating Safe Snap into their governance execution workflows.

In Brief:

Active votes:

We’re testing a proposal notification bot in our Discord, covering all of Tally’s supported protocols:

PoolTogether proposal 3 considers adding prize pool for its native POOL token:

Be sure to sign up on withtally.com to be notified of new proposals!

News:

Uniswap Grants approves first batch of funding:

Indexed Finance considers launching grants program:

Tron founder Justin Sun pursues Compound autonomous proposal for TUSD addition:

Aave launches lending market for Balancer and Uniswap liquidity pool tokens:

Compound begins gathering votes to propose governance upgrade:

Thanks for joining us for issue 23 of the Tally Newsletter! Be sure to check out the Tally governance app, and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally