The Tally Newsletter, Issue 3

October 27, 2020

We’re back with our third installment of the Tally Newsletter, a publication focusing on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

In this issue, we cover:

Uniswap Proposal 2 and suggested governance process

Compound and Aave exploring money market vote participation

Curve’s contentious whitelisting vote for Pickle Finance

New voting app for MakerDAO

Here goes!

—

Uniswap Proposal 2 and “Soft Governance”

TL;DR: Voting for Uniswap Proposal 2 is live this week, and the Uniswap team has published a suggested process for future governance initiatives.

After weeks of discussion and buildup, Dharma submitted phase 1 of their retroactive UNI airdrop proposal this past Saturday. The proposal would grant 400 UNI to users of several Uniswap integrators who did not receive the initial distribution due to an exclusion of proxy contracts.

Source: Uniswap.org, October 2020

At time of writing, the proposal had 20 million UNI in favor versus around 700,000 UNI opposed, but was still far short of the 40 million UNI quorum requirement. While this initially looks on track to pass, both Gauntlet Network and the Univalent delegation have signalled an intent to abstain from this vote, requiring around ⅔ of the remaining delegated UNI to vote in favor to meet quorum.

Separately from Dharma’s Proposal 2, Uniswap’s core team has also published an initial framework for “soft governance”. While the Uniswap system has hard coded rules and procedures, including the minimum proposal and quorum thresholds that were considered in Proposal 1, these alone are not enough to ensure effective governance. The new suggested process leverages forum discussions and Snapshot polling to build consensus around issues before proposals are formally submitted on chain.

—

Compound and Aave Explore Voting Options

TL;DR: Money market platforms’ forays into voting may have an outsize impact on decentralized governance.

With the recent addition of the cCOMP and cUNI markets, Compound has joined Aave as one of the largest holders of governance tokens. But while money markets have held governance tokens for some time, they’re only now exploring how to use the voting power present on their platforms.

Compound had been making swift progress with activating voting via the cUNI market. The liquidity of the cUNI market was to be delegated to the community multisig wallet, and cUNI holders would be able to vote in Snapshot polls to determine how the market would vote. But it emerged that this mechanism would be unsafe, as well resourced users would be able to lever up their cUNI position for as little as a few blocks to effectively control the market’s block of votes. Community member Arr00 is now considering how to safely address this vulnerability before moving forward.

In parallel, Aave is also considering a new approach to governance tokens. One option is to disable borrowing governance tokens to prevent governance attacks and enable voting with aTokens. An alternative plan would strictly limit governance token borrowing below key quorum and voting thresholds (eg. MakerDAO’s 50,000 MKR emergency shutdown limit).

Both Compound and Aave’s discussions are in early stages, but demonstrate the potential for money markets to become key power brokers in decentralized governance. Proof positive: Compound’s cUNI market already has more than the 10 million UNI required to submit proposals less than 1 month after it was first created.

—

Curve Whitelisting Vote for Pickle Finance

TL;DR: CRV voters nearly rejected Pickle Finance’s whitelisting request, raising questions about voters’ intentions and incentives.

Curve Finance uses a unique voting escrow system, wherein users must lock their CRV tokens for periods of up to 4 years in order to gain voting power and token utility. This is intended to increase user alignment, as voting power and benefits increase as tokens are locked up for longer periods.

To protect the integrity of the system, smart contract addresses must be pre-approved by Curve governance before they can lock votes and begin participating. This can be used to prevent smart contracts from tokenizing locked CRV to circumvent the original goals of voting escrow. But it also gives self interested voters a means of excluding others from CRV’s utility features and governance rights.

While Curve had previously whitelisted Yearn Finance, voters were not so accommodating of Pickle Finance’s request. One possible reason: rewards dilution for existing liquidity providers. Locking CRV tokens lets LPs boost their earnings by up to 2.5x, so whitelisting Pickle would lead to greater competition for the finite rewards pool.

Last minute voting swung the poll results in favor of Pickle’s whitelisting request, so the proposal will now proceed to an on chain DAO vote to enact the change. Expect more contentious votes as additional protocols seek to participate in Curve governance and yield farming.

—

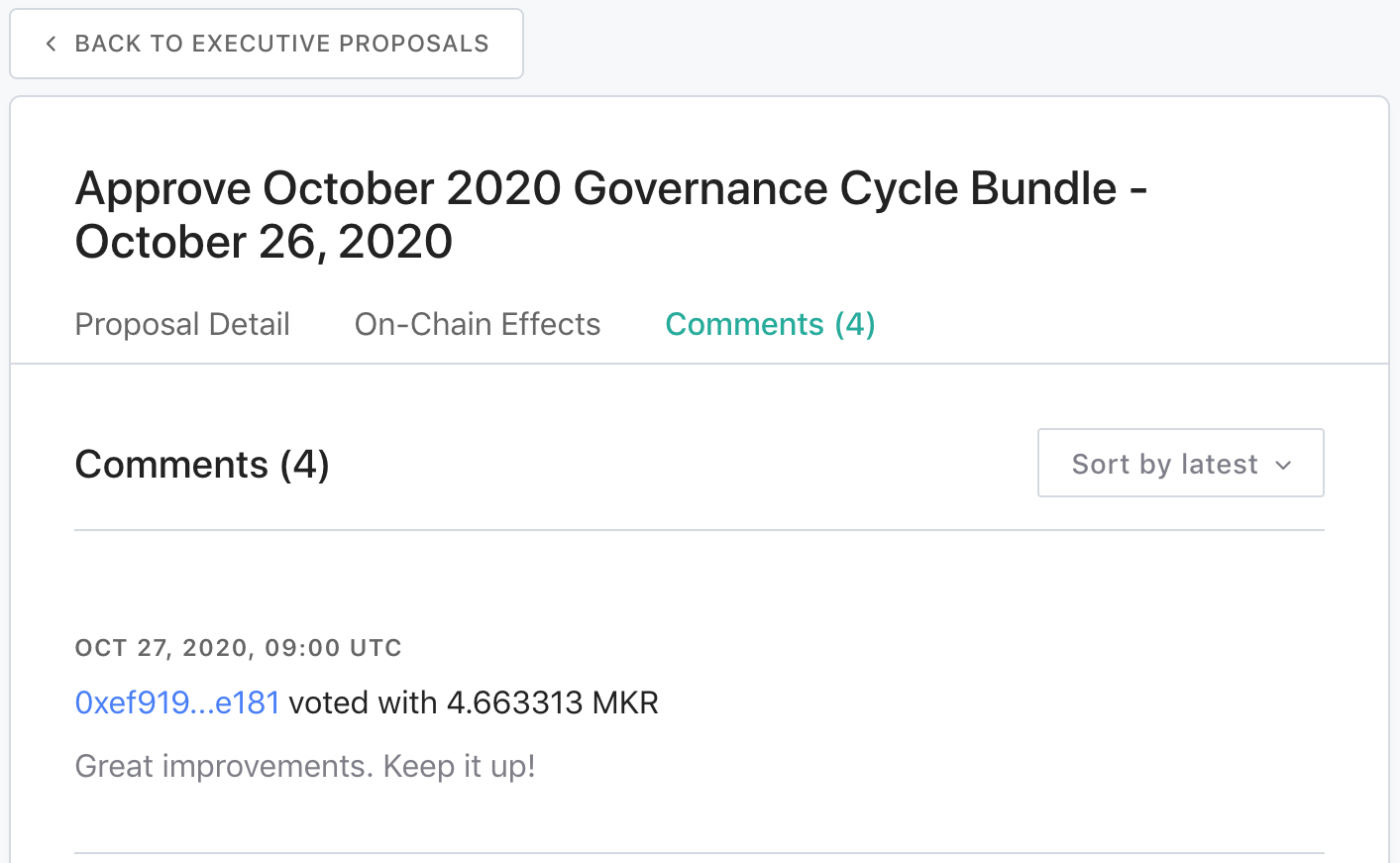

MakerDAO Releases New Voting Interface

TL;DR: The new interface batches poll votes in a single transaction to save time and gas, and offers a freeform comment section for executive votes.

MakerDAO’s new governance interface makes bold UX improvements. Previously, voters needed to submit an individual transaction for each poll in which they participated. This could be both costly and time consuming, considering that MakerDAO frequently has 10 or more polls within a single week. The new voting app submits all poll votes as a single ballot transaction, saving both gas costs and time waiting for transactions to confirm.

Source: MakerDAO, October 2020

MakerDAO has also included a feature that is entirely new to decentralized governance: freeform comments. With the MKR token’s fairly concentrated distribution, anonymous whales often have significant sway over vote outcomes. But these same large holders have limited means of expressing their views without revealing their identity, occasionally leading to shock vote upsets. The new feature lets users attach a comment to their votes via a simple signed message from their wallet, creating an outlet for pseudonymous, vote-weighted feedback.

While the main MakerDAO website now points to the new and improved voting app, the previous app will remain available at v1.vote.makerdao.com for the foreseeable future.

—

Thanks for joining us for issue 3 of the Tally Newsletter. We look forward to having you back for next week’s updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally