The Tally Newsletter, Issue 30

May 5, 2021

Welcome back for issue 30 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we have some exciting news, with the upcoming launch of Uniswap v3 and Maker Foundation’s return of hundreds of millions worth of tokens to the community.

Uniswap Launches v3

TL;DR: The pool factory contracts have been deployed and full public launch is expected imminently.

Uniswap has begun final preparations for the most anticipated product launch of the year. To recap, the v3 upgrade will revolutionize AMM liquidity provision with a few key improvements.

Concentrated liquidity: Liquidity providers will be able to target their assets within specific price ranges, allowing for greater capital efficiency.

Several fee tiers: V3 offers three fee options to suit different assets based on their volatility levels.

With the two of these features together, Uniswap is now able to compete in the previously out of reach stablecoin swap market. But at present there’s still some doubt if it can challenge the reigning incumbent Curve.

Curve is offering millions of dollars worth of incentives to keep liquidity providers engaged with the platform and ensure the deepest capital pools. At the same time, Curve’s 0.04% swap fee remains 20% below the lowest 0.05% swap fee tier offered on Uniswap v3 at launch, which could help retain trade volume.

But as Hayden noted, there may still be advantages for LP profitability and trader UX even despite higher swap fees. For example, Uniswap governance has limits on protocol fee extraction, with a maximum of 25% of trade fees diverted to the treasury, which potentially positions it as a better capital for LPs over the long term once Curve incentives decline.

V3 gives governance considerable power over development and operation of the system. This includes management of protocol fees on a per pair basis (which could be used to funnel LPs in certain assets to a single dominant fee level), and even creation of new fee tiers if necessary.

Maker Foundation Returns 84,000 MKR to the DAO

TL;DR: The returned tokens represent a roughly 8% reduction in outstanding supply, giving Maker a significant financial windfall as it transitions to full DAO funding.

The Maker Foundation has been publicly planning its dissolution for the past several years. But with the recent adoption of the Core Unit contributor framework and Maker’s recent financial strength, the pieces are finally in place for them to begin closing up shop.

They recently took this opportunity by returning 84,000 MKR tokens to the DAO. With a nominal value of over $400 million, this represents several years worth of protocol cash flow and gives Maker a substantial cushion for capital spending or other costs. But while it is impressive to retain a nominal 9 figure balance sheet, Maker is highly likely to burn the tokens once governance has an opportunity to consider the matter.

This may seem counterintuitive to outsiders, particularly considering Maker’s risks from its large balance sheet of margin loans and its burgeoning workforce expenses. As an example the protocol engineering team has requested and received voter approval for roughly 4,000 MKR per year in contributor vesting incentives, with other teams likely to follow.

In MakerDAO’s case this management strategy makes sense as the MKR token is mintable via governance vote - voters are free to burn the treasury MKR balance knowing they can always issue more in the future if necessary. So while this massive return of funds may not lead to an immediate increase in spending, the Maker community may be more willing to open the purse strings as time goes on.

In Brief:

Inverse Finance executes merger with Tonic Finance, after proposal passed with absolute majority of support:

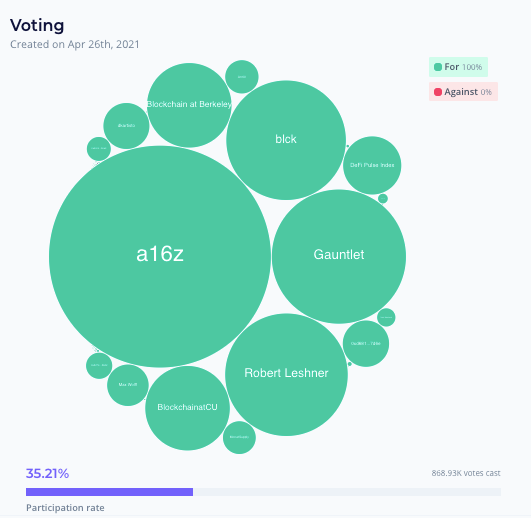

Compound passes deprecation proposal for REP and old WBTC markets:

Paradigm and others participate in Lido DAO treasury diversification:

Aave votes on Grants program proposal:

PoolTogether (pictured) and B.Protocol consider liquidity incentives for their native token:

Thanks for joining us for issue 30 of the Tally Newsletter! Be sure to check out the Tally governance app, join us on Discord, and subscribe to our protocol calendar for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally