The Tally Newsletter, Issue 34

June 2, 2021

Welcome back for issue 34 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover some blockbuster proposals from Uniswap governance:

Community support for launching v3 on the forthcoming Arbitrum rollup

Harvard Law Blockchain Initiative’s proposed legal advocacy fund

Community initiative seeks to lower proposal submission threshold

Plus brief updates from around the ecosystem.

Uniswap Will Launch v3 on Abritrum

TL;DR: With strong support for a Snapshot proposal to launch on Arbitrum, the Uniswap Labs team has committed to deploying the contracts on behalf of the community.

After a months long period of relative inactivity, Uniswap governance is now beginning to see a burst of activity. This is a welcome change for a protocol that had faced criticism for lack of participation.

The first proposal to break the seal was submitted by former Maker dev and community member Andy8052. He advocated for launching on the Arbitrum rollup to allow Uniswap to better serve users across various EVM compatible networks. While this might seem like a no brainer, there are a few reasons why this was far from assured.

Some had raised concerns about negatively impacting users through “fractured liquidity”, where the liquidity available on any one venue is insufficient to meet demand. But Uniswap v3’s efficient design helps reduce the impact of fragmentation by offering greater depth for a given amount of capital. Network transaction costs will also be far lower on L2 environments, so liquidity providers should be able to adjust their positions dynamically to meet the needs of the market.

A larger concern in the background was doubt about the Uniswap team’s incentives. VC fund Paradigm is the lead investor in Uniswap, and is also one of Optimism’s largest backers. This led some to worry about pressure to favor Optimism integration at the expense of launching on other L2s. With Arbitrum now expected to go live weeks or months before Optimism, this quickly became untenable.

The Snapshot vote gained massive support, surpassing Uniswap’s regular 40 million vote quorum threshold within hours. Discussion then turned to implementation, as it wasn’t immediately clear how this would work. Noah Zinsmeister of the Uniswap Labs team offered a concise explanation of the process, relying on Uniswap governance’s control of the v3 license via the uniswap.eth domain.

In the end, altering the license won’t be necessary as the Uniswap Labs team has committed to deploying v2 on Arbitrum themselves. While timelines to deployment remain unclear, this episode has shown the value of sentiment voting for aligning contributors and the wider community.

Voters Consider Funding Legal and Regulatory Advocacy

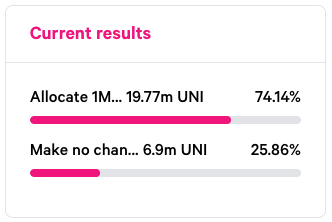

TL;DR: The proposed 1 million UNI grant would be the largest single non-liquidity incentive expense undertaken by a DAO.

Over the past few months, several university blockchain groups have received delegation in Uniswap governance. Leading the pack is Harvard Law’s Blockchain and Fintech Initiative, currently holding over 10 million votes. But while these organizations have gained considerable voting power, their participation has generally remained limited.

Source: Tally

In the past week, Harvard Law Blockchain has broken the mold with an ambitious governance proposal that seeks to defend defi’s legal and regulatory standing. This has important implications for decentralized governance, as protocols and contributors currently face unclear but potentially significant risks. To give a few examples:

Protocols or genesis teams could fall afoul of securities regulations

Delegates may face registration requirements under proxy advisory rules

Exchanges and lending platforms could be forced to register as broker dealers

Protocols could be considered general partnerships, placing large liability on participants

Concern about tax liability makes it difficult to pursue treasury diversification

The initial temperature check vote met a mixed response, largely due to a lack of clarity around use of funds and the large amount of funds requested. Harvard Law responded with a much more thorough explanation of their strategy, as well as a proposed committee of well respected legal experts to oversee the program.

While this has helped allay concerns, there are a few remaining doubts about the process that the community is working through. If Uniswap leads funding for this initiative, there’s a potential for a free rider problem where other defi protocols benefit without bearing a fair share of the costs. The request for a large lump sum distribution also makes it more difficult to assess performance or change strategy later if UNI holders no longer support the initiative.

Source: Snapshot

A second Snapshot poll is also on track to pass in the coming days. But if a minimum of 40 million yes votes are not reached, this indicates the proposal lacks enough support to pass an on-chain governance vote. Greater oversight powers for governance and participation from additional stakeholders may help build consensus for the proposal.

Uniswap Considers Reducing Proposal Submission Threshold

TL;DR: Reducing the proposal threshold could expand the pool of potential proposers, while maintaining roughly equivalent governance security.

To top off the previous initiatives, Uniswap voters have also given initial support for reducing Uniswap’s proposal submission threshold. To review, this value is coded into the core governance contract, and determines the minimum voting power required to start a proposal. While this helps defend governance against spam and low quality initiatives, a higher quorum threshold must be met before a vote passes, offering a second and more resilient layer of security to the voting process.

Currently, the proposal threshold is set to 1% of total token supply (10 million UNI), amounting to over $200 million in voting power. With the value of UNI rising around 10x from last year’s lows, it’s unclear if this high of a value is still necessary.

With the Snapshot vote resolving favorably, the next step is to solicit support from the 10 million votes required for the current proposal threshold via a community autonomous proposal. While this initiative is likely to pass (having received 46 million votes in the Snapshot poll), it may be a missed opportunity to upgrade Uniswap’s governance from the Alpha to Bravo version. Bravo offers a few key benefits including upgradability of parameters (so future parameter changes like this would not require a contract migration) and the option to add freeform text reasoning to votes.

In Brief:

Frax Finance makes Curve governance whitelisting proposal to allow deeper integration, including a commitment to buy and lock $1 million of CRV:

Sushiswap considers proposal to retain earnings in treasury by lowering xSUSHI payouts:

MakerDAO lowers interest rates to try to reduce growing USDC exposure:

Opportunities:

PoolTogether grants opens applications:

PieDAO makes open call for community fund managers:

Defi grants aggregator shows funding available from top protocols:

Flipside Crypto’s Bounty Brief newsletter collates funding for defi data analysis

Thanks for joining us for issue 34 of the Tally Newsletter. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally