The Tally Newsletter, Issue 36

June 16, 2021

Welcome back for issue 36 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover:

Curve’s conflicts with Alchemix and supporting protocols

MakerDAO community struggles to reduce USDC exposure

Plus brief updates from around the ecosystem.

Curve Moves to Block Rewards for Alchemix Pools

TL;DR: Some felt underlying Yearn vaults’ CRV sales allowed Alchemix users to double dip on rewards, but this logic could also apply to certain other supported assets.

While the defi governance space is rarely short of drama, this past week has seen a burgeoning conflict between Curve Finance and two of their primary integrators, Yearn and Alchemix.

It seems the spat was initially kicked off by the Curve team’s reluctance to add rewards for the forthcoming Alchemix alETH pool. Alchemix is a protocol for non-liquidatable, self repaying loans - under the hood collateral is held within Yearn’s vaults, and yield earned is used to gradually repay the debt without requiring user action.

alETH is backed by Yearn’s yWETH vault, which generates the bulk of its returns through participation in Curve pools and CRV rewards. By borrowing alETH against these vault shares and then reinvesting the proceeds back into the vault, users can lever up their returns and contribute a higher effective amount of liquidity per unit of invested capital.

Because Alchemix relies heavily on Curve inflationary rewards to support their core product, some Curve community members raised concern that it was unfair to also incentivize liquidity pools for alETH as well - users could potentially earn CRV on their collateral plus an additional layer of rewards by reinvesting the borrowed amount.

With the likelihood of being refused rewards for the alETH pool, Alchemix developers decided to launch their incentivized ETH pool on Curve competitor Saddle Finance instead. This evidently didn’t play well with Curve, who has alleged IP infringement against the Saddle team for their implementation of Curve’s stableswap AMM model.

This was followed by Curve beginning a discussion and governance process to remove CRV rewards from the already supported alUSD pool, which represents a much larger part of Alchemix’s business. This also heavily impacts Yearn, a key Curve participant which has received hundreds of millions in deposits in its DAI vault through Alchemix.

While the argument against rewards double dipping has some appeal, this may not be the best way of approaching the issue. For example, the alUSD have relatively high trading volume compared to the amount of rewards issued, implying better profitability to CRV holders.

As a counterpoint, the recently added USDP pool (via Unit Protocol) has much lower liquidity utilization and contribution to CurveDAO revenue, while receiving 3 times higher rate of rewards. Unit Protocol is also integrating leverage on Curve positions directly into their borrowing platform, allowing users to have similar leveraged farming exposure as Alchemix. Divergence in Curve’s treatment of the various LP leverage platforms could point to a more strategic approach to integrations, systematically favoring protocols that avoid Curve competitors.

MakerDAO Struggles with Growing Stablecoin Exposure

TL;DR: The community is considering several mitigations, including stablecoin reserve diversification and improved terms for borrowers.

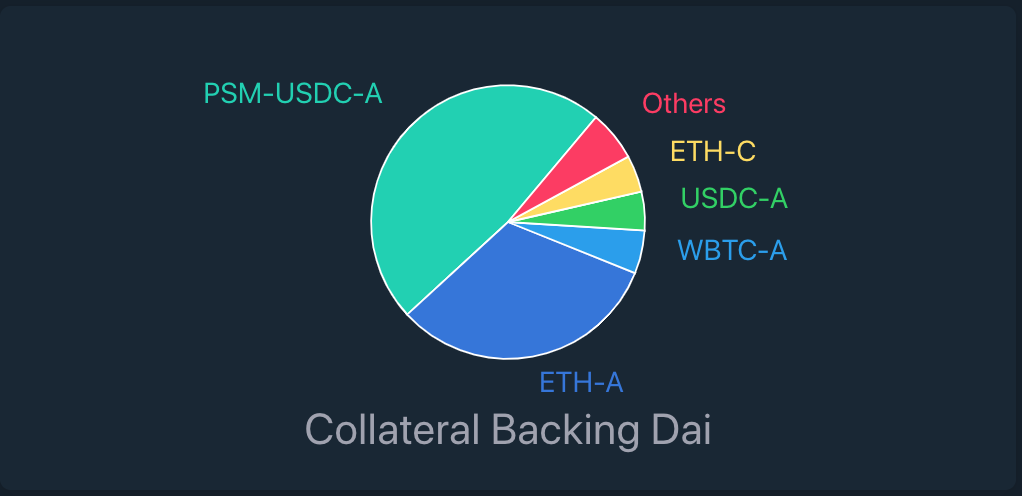

Starting with the price crash on May 19, market sentiment has dropped considerably. With this, we’ve seen an increase in stablecoin demand and a sharp drop in leverage seeking. Both of these factors have had a drastic impact on MakerDAO’s collateral pool and loan book.

In order to limit DAI price rises, Maker has implemented a feature called the peg stability module which mints new DAI on demand in exchange for USDC. While this has eliminated the volatility and persistent premium DAI experienced through last year’s defi summer, it also allows for substantial increases in stablecoin exposure.

In the past month, DAI generated from the peg stability module has ballooned by a factor of 3x, from under 800 million to 2.5 billion today. This represents a serious threat to the protocol’s stability, via a few risk factors:

Credit and default risk of USDC

Potential for regulatory attacks or blacklisting

Liability risk if assets can be seized via lawsuits

With over 50% of the DAI supply secured by USDC, it’s now more pressing than ever for MakerDAO to address the imbalance.

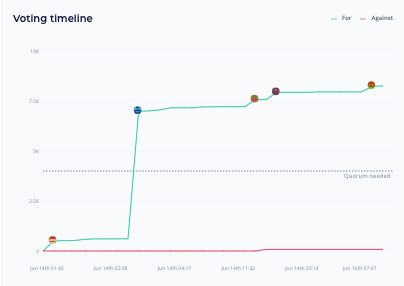

Interest rates are Maker’s primary tool to handle peg imbalances, and Maker’s rates setting group proposed broad reductions in borrowing costs by early June. But as the rates group is an advisory body without execution authority, the process for implementing these changes has presented its own issues.

Rates changes are generally proposed after the first Monday of each month, but governance votes to confirm the changes are only submitted the following week and can take additional time to receive enough support to pass. As of today, the executive vote to implement these key changes is still pending 5 days after submission.

In addition to reducing stablecoin exposure in general through borrowing rate reductions, the Maker community is considering addition of new peg stability modules for GUSD, PAX, and BUSD to help diversify credit risk between issuers. While all 4 of the stablecoins are US based and potentially have similar legal and regulatory exposure, they are managed by separate institutions and have varying levels of disclosure of their reserves. GUSD has an additional benefit of short term censorship resistance, as the ability to add a seizure function to the contract is behind a multi day timelock.

There’s also been various discussions of investing the USDC collateral into yield opportunities. But Maker faces considerable challenges in this area as well. It’s still unclear how Maker can own assets off chain (such as US treasury bills) without high risk and custody expenses. And for defi native yield opportunities, investment could lead to further pressure on Maker’s collateral pool; lending the USDC in defi would push down rates and reduce demand for Maker’s core vaults (limiting DAI supply), while supplying to a stablecoin AMM such as Curve would increase demand for DAI to balance out the pool proportions.

In the short term the focus will likely remain on encouraging more crypto backed loan demand through lower rates. But Maker may also need to shorten the rate setting feedback loop to avoid future spikes in stablecoin exposure. Optimistic execution mechanisms like Tally Failsafe might be able to support more agile decision making without increasing governance or contributor risk by allowing contributors to execute changes directly, subject to token holder veto.

In Brief:

Alchemix’s new alETH derivative faces potential vulnerability:

Cream money market faces losses on SWAG tokens from loans opened last fall:

Lido Finance reaches 500,000 ETH staked in their stETH product:

Inverse Finance on track to onboard stETH to Anchor lending protocol:

Curve community member proposes DAO directed legal action against potential IP violations:

Volmex launches tokenized crypto volatility products on mainnet:

Opportunities:

Aave Grants funds first batch of projects, with further funding available:

Flipside Crypto extends community analytics program to Compound:

Thanks for joining us for issue 36 of the Tally Newsletter. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally