The Tally Newsletter, Issue 38

June 30, 2021

Welcome back for issue 38 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover some suspicious activity in the Compound governance system, plus brief updates from the wider ecosystem.

Compound TUSD Proposal Raises Concern of Suspicious Market and Voting Activity

TL;DR: A wallet believed to be owned by Justin Sun has used borrowed COMP tokens to support his recently acquired TUSD stablecoin, and makes up the majority of the TUSD market.

While protocol governance is usually carried out with minimal drama, the Compound protocol has seen some intrigue in the past week surrounding a proposal to increase support for TrustToken’s TUSD stablecoin.

TUSD had previously been onboarded in Proposal 45 with no borrowing power (0% collateral factor) or COMP incentives for borrowers or lenders. The low cost and risk to the protocol made this relatively uncontroversial, with only two abstentions and no one voting against.

But below the surface, there were some questionable tactics actions surrounding the onboarding and usage of the cTUSD market.

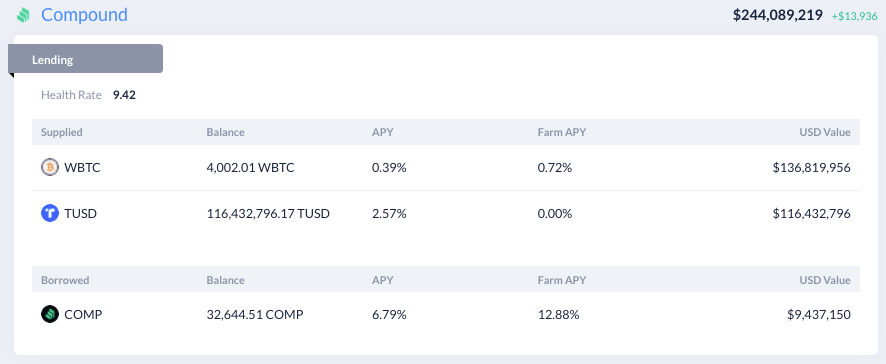

A wallet widely reported to belong to Tron founder Justin Sun was one of the first depositors to the new cTUSD pool after onboarding with a $60 million commitment. Over time this market share has grown, now comprising over $100 million in value and over 95% of total TUSD deposits.

While deposit activity is generally beneficial for Compound (deeper stablecoin liquidity benefits borrowers), this case presents some risk due to the single user’s huge influence on the pool and ability to effectively control utilization and interest rates. Of greater concern is the wallet’s other engagement with the protocol lending markets and governance, which touches on several of Compound’s weak points.

The user has borrowed nearly $10 million in voting tokens (37,000 COMP), which presents two issues for the protocol. First, the cCOMP market only allows for borrowing up to 100,000 COMP in total, and once this limit is reached borrowers can effectively be paid for removing liquidity due to the protocol’s ongoing incentives for the cCOMP pool. The community is now considering removing this borrowing limit, which would allow additional borrowing to drive up market interest rates to an equilibrium level, and hopefully make non-economic borrowing more costly.

However, removing the borrow cap on COMP would potentially increase risk from this address in other ways. In addition to earning an effective 5% yield on the COMP they borrowed from the protocol, they have also used the borrowed tokens to help push through the TUSD onboarding proposal. So any loosening of COMP borrowing limits could give the wallet owner greater influence in the protocol.

This is all coming to a head now due to the TUSD team’s recent proposal to increase TUSD borrowing power and introduce liquidity incentives. Based on the ~115 COMP per day proposed allocation to the cTUSD market and 50/50 split between suppliers and borrowers, this single user would be on track to receive over 50 COMP in rewards per day solely from their TUSD deposit.

Given the wallet’s link to Justin Sun and Sun’s widely publicized (but as yet unconfirmed) control of the Techteryx holding company established to buy TUSD, this turn of events seems to involve risk of undisclosed conflicts of interest and self dealing. In permissionless governance systems, the voting and token distribution mechanisms should be optimized for incentive compatibility directly. But social consensus and coordination against questionable governance tactics offers a key second line of defense against malicious participation.

In Brief:

Uniswap governance passes proposal for Defi Education Fund:

Flipside Crypto proposes Snapshot vote for community analytics grant endowment

Rari Capital votes to retain Quantstamp audit firm for the next year:

Compound Labs releases Treasury service to improve business and fintech access to defi yields:

Fei Protocol holds Snapshot poll on investing part of the treasury into Lido’s stETH staked Ether

Aave introduces new Snapshot space for off chain polling:

Opportunities:

Tally is hiring for several positions! Check out our job postings here.

Thanks for joining us for issue 38 of the Tally Newsletter. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally