The Tally Newsletter, Issue 39

July 8, 2021

Welcome back for issue 39 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we look at some key proposals from the Compound and Uniswap ecosystem, plus brief updates from other protocols.

Compound Considers Onboarding First Permanent DAO Contributor

TL;DR: Proposal 51 would initiate a streaming payment to Getty Hill for past and future work on Compound’s oracle system.

This week, we’ve seen the Compound community make their first moves towards hiring DAO contributors.

While certain protocols such as MakerDAO have embraced long term employment, the vast majority of DAOs are still taking an ad hoc approach to talent acquisition. In Compound’s case, this has included one off grants and bounties funded by the Compound Grants committee, as well as invoices attached to certain governance proposals (most notably Gauntlet’s Proposal 30 which allowed for direct COMP transfers to grantees along with a request for a 1,000 COMP allotment to cover costs and future engagements).

These initiatives have been largely considered a success. But a series of informal or short term engagements may not be the best framework for handling all aspects of DAO management.

Proposed grantee Getty Hill’s work for the protocol so far has represented just such a case. After the wave of DAI market liquidations last November, caused by reliance on a single price feed from Coinbase, the community agreed that oracle improvements were necessary. But there were a wide variety of potential solutions, ranging from adding additional feeds to the open oracle system to transitioning to new oracle providers such as Chainlink or Band.

Getty took proactive steps to investigate and spec out potential options, drive community discussion forward, and settle on a final implantation that was acceptable to COMP holders. This was driven by a results oriented approach to oracle safety rather than catering to pre-set deliverables. And the work on Compound oracles will continue well into the future, with potential improvements needed such as migrating the oracle’s fallback reference price from Uniswap v2 to v3 as liquidity shifts.

Considering the ongoing work involved in maintaining and improving Compound’s oracle infrastructure, Getty has proposed a streaming grant of ~500 COMP per year to join as a retained contributor. Voting on proposal 51 will run from today through 3pm UTC Sunday on Tally. If this proposal is adopted, we could see a wave of further contributor streaming payments. Compound has a wide range of responsibilities such as risk management and asset onboarding that could be well suited for a longer term engagement.

Governance faces some operational risk of paying streams entirely in COMP tokens, due to potential price changes pushing the rate of compensation above or below fair market value. But with a large and growing warchest of stablecoins (currently over $20 million) earned from their money markets, Compound has the flexibility to structure payments with a balance between stability and incentive alignment.

Uniswap and Compound Consider Governance Parameter Changes

TL;DR: Compound proposal 52 would reduce the threshold to submit proposals, while a Uniswap snapshot proposal advocates for higher quorum requirements.

Following on shortly after Proposal 51, Polychain Capital has commenced a new Compound vote intended to broaden access to governance.

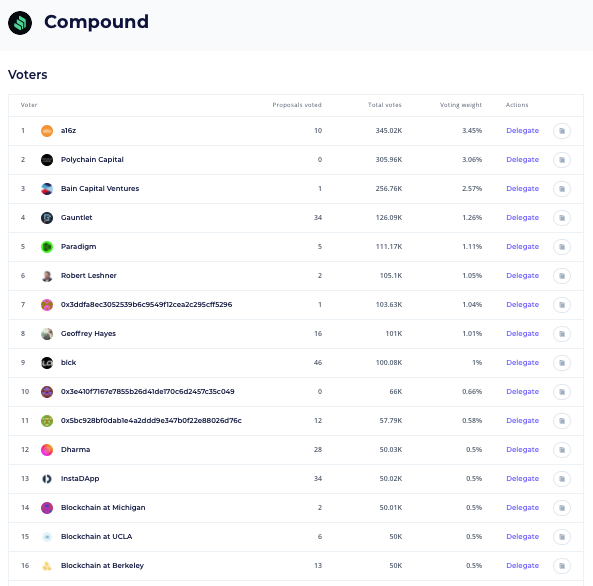

The new proposed limit of 65,000 COMP is still a considerable sum, amounting to over $25 million at current prices. Additionally, based on current delegation statistics it would allow only 1 additional address to meet the proposal threshold, with total potential proposers rising from 9 to 10.

While this doesn’t change the delegation landscape too much, it makes community autonomous proposals significantly easier to organize. In Compound based governance systems, vote delegation extends to only one degree of separation from the original token holder; delegates can’t re-delegate votes received from a third party. This helps minimize gas expenses and reduce governance complexity, but also severely hamstrings the autonomous proposal mechanism as only token owners rather than delegates can offer support.

Most recently, this dynamic played out with Compound’s Proposal 47 which upgraded the oracle system to use Chainlink feeds. While the proposal was submitted as an autonomous proposal, it relied on Polychain’s 300,000 votes in support to be submitted as a full governance vote. With a lower submission threshold, it becomes more feasible to gather support from small community members.

This is a limited change compared with Uniswap’s recent Proposal 4 to reduce submission thresholds by 75% (from 10 million to 2.5 million UNI). But with Compound’s current Governor Bravo infrastructure, this change will not require a governance contract migration and can be followed up with further reductions in the future. Voting will be live from Friday through 10am UTC on Monday on Tally for those wishing to participate.

Uniswap faces slightly more difficulty with governance parameter changes. As Uniswap still relies on the non-upgradable Governor Alpha mechanism, the proposed increase to quorum requirements would require moving to a new contract (potentially a Governor Bravo version to avoid further migrations in the future).

Penn Blockchain, the student delegate group leading this effort, has justified the increase based on the general increase in delegated voting power since Uniswap governance launched last fall. On the other hand, most UNI voting power is still held by investors and team members (either directly or through delegation to others). Raising quorum requirements could allow these holders to block proposals through inaction, instead of being forced to actively vote against proposals they take issue with.

While this change will likely have a limited impact on governance outcomes, it’s encouraging to see more protocols take an active interest in their voting infrastructure. Ensuring governance safety and alignment requires an evidence based approach to parameter selection, and Uniswap’s recent parameter change proposals seem to be heading in this direction.

In Brief:

Ampleforth and Conjure governance join the Tally site:

Balancer launches pools for stable value assets:

Gauntlet proposes new fee updates to Balancer’s managed pools:

LidoDAO considers renewal of Unslashed insurance coverage for stETH:

Index Coop proposes metagovernance committee to ensure active voting:

Opportunities:

0x Protocol launches grants program:

Llama Community seeking input on DAO accounting standards:

Tally is hiring for several positions! Check out our job postings here.

Thanks for joining us for issue 39 of the Tally Newsletter. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally