The Tally Newsletter, Issue 49

October 27, 2021

Welcome back for issue 49 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week look at Uniswap’s potential new rock-bottom fee tier option, and impacts on the overall DEX space. And don’t miss brief ecosystem and product updates, plus updates on NFT DAOs at the end of the issue!

Uniswap Votes on Ultra Low Fee Tier

TL;DR: The proposed 0.01% fee tier for Uniswap v3 pools would be the lowest swap rate available in defi, potentially pulling liquidity and volume from competitors and eroding DEX earnings.

For much of Defi’s history, the default swapping rate on decentralized exchanges was 0.3% of each trade, as set by the category leader Uniswap. This allowed liquidity providers to earn a high rate of return and offset losses caused by price divergence.

In addition to innovating on concentrating liquidity within certain ranges, Curve Finance also introduced a much lower trading fee of 0.04%, which helped improve liquidity for stablecoins and other stable value assets. When Uniswap launched version 3 earlier this year, which allowed for concentrating liquidity to rival Curve’s capital efficiency, they also offered a 0.05% fee tier to be able to compete on stablecoin swaps.

But surprisingly, Uniswap has seen the low fee tier option take prominence not just in stablecoin trading, but also for other large cap assets in unstable pairs. The image below shows the current highest volume pairs on Uniswap; notice how 4 of the 5 are unstable pairings using the 0.05% fee tier.

Source: Uniswap Info

This feeds into a recent proposal from the Uniswap forums that could have a huge impact on the DEX market.

Community member and delegate Getty Hill proposed adding the option for users to create pools with a 0.01% trading fee, the lowest in the industry currently. This would allow Uniswap to outcompete Curve’s 0.04% fee, likely taking nearly all volume from the current leader in stablecoin trading until they respond with lower fees of their own. As a side effect, Curve protocol revenue derived from their 50% share of trading fees would be eroded and total value deposited could also decrease from falling CRV token rewards.

While this would position Uniswap well against competitors, it may also cause an own goal from a value accrual perspective. The Uniswap DAO has the ability to claim up to 25% of trading fees, but it’s unclear if trading volumes can increase enough to counter the impact of lower fees on protocol revenue. The new fee tier option could also accelerate the shift towards lower fee tiers for non-stable trading pairs, with large cap tokens potentially moving to 0.01% fees and smaller assets moving from 0.3% or 1% down to 0.05% fees. This will drive serious margin compression for protocols and impact liquidity provider returns, but will give DEX traders an improved experience with lower cost and potentially help cement Uniswap as the premier exchange protocol for users.

In the background, the proposal may also be driven by new competitive factors in the DEX space from non-traditional actors: MakerDAO and OlympusDAO. As we discussed in our last newsletter, MakerDAO is considering reducing fees for stablecoin trading through the peg stability module to 0%, with an initial poll passing recently. Olympus is also looking into offering stablecoin swaps with their treasury assets at a 1:1 ratio, and these two new entrants could undercut DEX market share unless fees drop substantially.

Voting for the Uniswap proposal is live on Snapshot through October 29, and will then move to an on chain vote. So far it has seen unanimous support from voters, showing that Uniswap DAO members continue to focus on product over revenue.

Tally Product Update:

You can now connect your wallet to withtally.com using WalletConnect in addition to Metamask! This should make it easier to interact with your favorite DAOs on Tally, regardless of your preferred wallet or device.

Tally is focused on bringing the best experience to the DAO community. We’re always open to product feedback!

In Brief:

Cream Finance faces flash loan exploit, with loss of $130 million:

Sushiswap votes on community analytics proposal from Flipside Crypto, similar to the previously rejected Uniswap proposal:

Curve Finance considers removing the smart contract whitelist for interacting with governance and veCRV vote locking mechanisms:

Worldcoin project proposes solution to sybil problem with biometric based cryptocurrency, causing controversy over privacy:

Indexed Finance holds series of polls on hack response:

Terra’s founder Do Kwon was served by the SEC at the recent Messari Mainnet conference, possibly related to Mirror Protocol’s synthetic stocks and suggesting future conflict between Mirror’s DAO and regulators:

A16Z researchers suggest potential structure to allow DAOs to receive the benefits of legal recognition:

NFT DAOs:

Dope Wars DAO submits first on chain proposal:

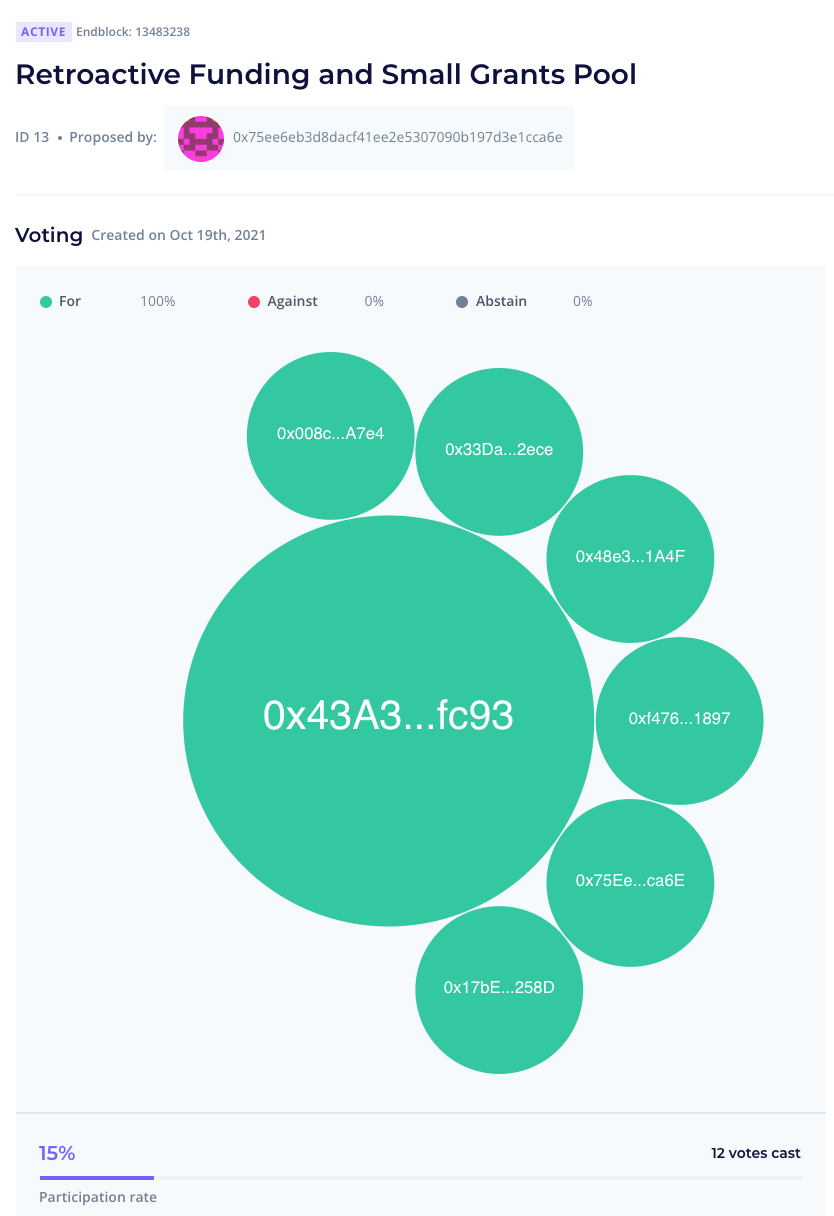

Nouns DAO votes on funding grants multisig:

Thanks for joining us for issue 49 of the Tally Newsletter. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally