The Tally Newsletter, Issue 51

Welcome back for issue 51 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week cover:

Fei Protocol’s Partnership Proposals with Balancer and Tokemak

xDAI Considers Gnosis Merger Offer

Paladin Vote Renting Platform Launches Governance Token

Plus quick ecosystem and product updates!

Fei Protocol Considers Series of DAO Partnerships

TL;DR: Proposed partnerships with Balancer and Tokemak include treasury swaps and improved liquidity support for FEI.

As Fei approaches their v2 launch, they have come out with a series of cross protocol partnership proposals that should help drive deeper liquidity and utility for their project tokens.

First, Fei and Balancer protocol are considering a treasury swap of BAL tokens for a combination of FEI and TRIBE. With Fei v2 built largely on Balancer’s smart pool architecture, this swap will help build trust and incentive alignment between the two protocols.

If approved, Fei will deposit their BAL in a BAL/ETH liquidity pool, earning additional liquidity rewards and fitting into their long run treasury diversification strategy. Balancer could also benefit from additional non native treasury assets, particularly the portion of FEI stablecoins which can be used to fund operating expenses without BAL dilution.

There has been some dissent with around 20% of BAL votes against the proposal, possibly because TRIBE would be a non-core asset that doesn’t directly fit into Balancer’s product strategy. But the proposal is still likely to pass based on current vote totals and historical participation in Balancer governance.

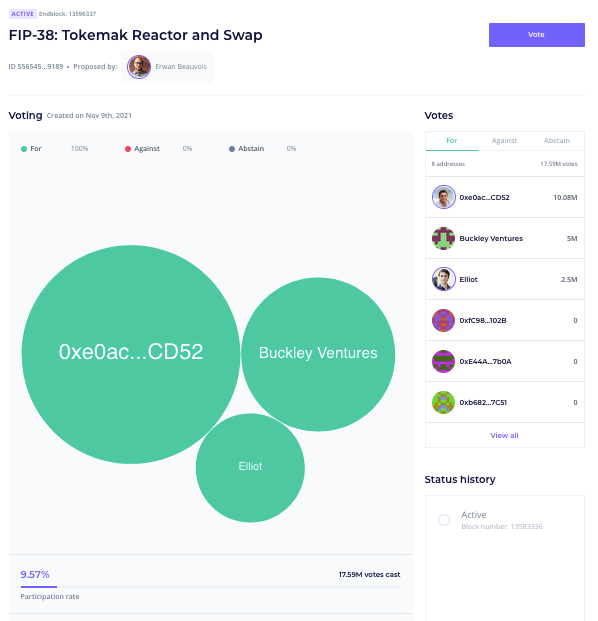

In addition, Fei is also pursuing a similar partnership plan with Tokemak, which is a protocol for automated liquidity provision that can help direct funds towards the Fei protocol ecosystem tokens.

Source: withtally.com

The initial proposal from the Fei side would deposit 10,000 ETH into Tokemak’s single sided staking pool, with a commitment to deposit a further 6 million TRIBE tokens and potentially also FEI stablecoins into Tokemak if and when pools are created for these assets. While Tokemak hasn’t yet considered any reciprocal actions, Fei’s first steps may make TOKE holders more willing to support collaboration in the future.

With a large treasury of non-native treasury assets, Fei has the financial resources to pursue DAO to DAO partnerships at scale. But it may be difficult to maintain focus while integrating with so many disparate projects, and it remains to be seen how Fei will manage their growing governance powers within external protocols.

Gnosis Proposes Acquisition of xDAI Chain

TL;DR: This proposal would result in a conversion of STAKE tokens into GNO, and fold xDAI chain into Gnosis’s wider scaling plans.

Gnosis made waves this week with an ambitious proposal to acquire the xDAI sidechain and linked STAKE validator token. While many other EVM sidechain and L1 projects have seen huge growth in price and adoption in the past year, xDAI has lagged competitors. Gnosis similarly has lagged the market despite having one of the largest treasury reserves in the space. The new proposal has the potential to galvanize both projects, but also brings various governance risks.

The deal would resemble a tender offer from traditional finance space, with each STAKE holder receiving a share of Gnosis’ GNO tokens based on a discount from the average price from just before the deal was announced. While the market initially reacted favorably to the proposal, it has since given back nearly all of the recent gains and the xDAI community seems to be skeptical as shown by negative comments in their forum.

Source: xDAI forum

While the proposal would yield an immediate mark to market increase in value for token holders (with the GNO/STAKE conversion price favoring STAKE holders), the xDAI community would lose autonomy and would become part of a much larger and more capital intensive organization.

Gnosis has had widely publicized governance fights in the past, with minority parties upset about excess capital being hoarded instead of being returned to token holders. Given this governance risk, STAKE holders may feel they have more upside potential as an independent project. But on the other hand, many other EVM sidechains have initiated large ecosystem incentive programs, and Gnosis’s deep pockets could help xDAI remain competitive with better resourced peers while continuing to fund core research and development.

Forum polling is notoriously unreliable, so while initial votes have shown community opposition to the merger we may see a change of momentum as token weighted voting begins. Gnosis is fairly closely held, so the biggest question to the deal is how many large STAKE holders are onboard with the acquisition plans.

Paladin Launches Token with Airdrop to Other Protocols’ Voters

TL;DR: The broad token distribution could help combat stigma around vote renting.

Paladin.vote is a protocol for borrowing and lending token governance powers. It can offer these vote based loans without collateral, as only the voting power is delegated while tokens themselves remain in the protocol’s smart contracts. In this sense, it’s somewhat similar to the trustless bribing mechanisms introduced into the Curve Finance ecosystem. But while Curve and Convex bribes have a high level of community support and are focused on influencing liquidity mining reward allocations, trading in votes is much more controversial in the projects covered by Paladin (Compound, Aave, and Uniswap).

Paladin’s recent PAL token airdrop may help make inroads into these communities. In addition to allocations to active Paladin discord users and protocol depositors, nearly 90% of airdropped funds were granted to COMP, AAVE, UNI, and CRV holders who participated in on chain governance voting in their own protocols. In addition to buying goodwill, this airdrop mechanism also selects for more engaged governance activists and helps filter out sybil accounts (who are less likely to pay the gas fees required for on chain voting).

Paladin also borrowed a mechanism from the Inverse Finance token distribution from the beginning of the year; tokens initially are non-transferable and have no market value, only allowing for participation in Paladin protocol governance. While it is assumed that governance itself will eventually allow for transferability, this gives an opportunity to build up a core base of support and also gauge token holders’ participation. Paladin could even follow Inverse’s lead and revoke tokens from non-active DAO members before the token begins trading.

Tally Updates:

We’re excited to announce that Elysia is now listed on withtally.com! Remember that in order to vote on a proposal, you must first delegate your vote to yourself or to another member of the community. You can review proposals and set up your delegation here: https://www.withtally.com/governance/elyfi

In Brief:

Governance vote buying mechanisms expand from Curve and Convex protocols to Tokemak:

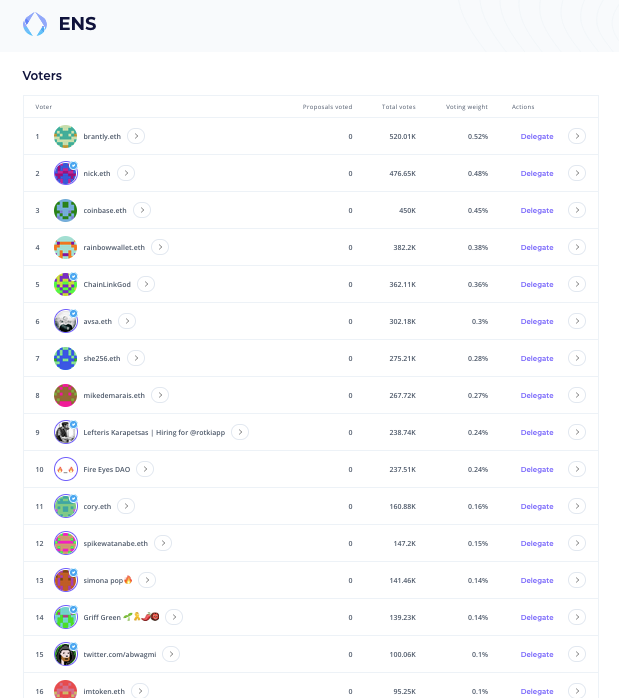

ENS sees governance successful launch with hundreds of delegates and broad vote distribution:

Ampleforth token market on Aave experiences a week of full utilization due to positive rebases exceeding borrowing costs, blocking user withdrawals:

Compound passes proposal 68, ending incentives for borrowing COMP that had caused market distortion:

Thanks for joining us for Tally Newsletter issue 51. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally