The Tally Newsletter, Issue 55

December 10, 2021

Welcome back for issue 55 of the Tally Newsletter, a publication focused on all things decentralized governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover Sushiswap’s governance upheaval, plus brief updates from around the DAO ecosystem.

Also a small request for our readers - Tally is working to create solutions for DAOs’ greatest challenges. We would greatly appreciate your help filling out this short survey https://bit.ly/3DeFT7Y (survey closes on December 15) so that we have a better understanding of the DAO problem space.

Sushiswap in Turmoil Over Team Compensation and Protocol Direction

TL;DR: Internal issues at Sushiswap have reached a breaking point, triggering several proposals to realign governance and management.

In the past week, Sushiswap has seen internal tensions spill into the open. While this conflict is specific to the Sushi project, it bears similarities with operational struggles around chain of command and team relationships that impact many other DAOs as well (see MakerDAO’s recent contributor offboarding proposals).

The flurry of activity was partly kicked off by the firing of core contributor AG. Additional attention was driven by former member BoringCrypto, creator of the Bentobox software underlying Sushi’s Kashi lending as well as Abracadabra’s MIM stablecoin. While personal enmity seemed to play a role in the comments, there were also concerns raised about transparency and funding accountability.

On the other hand, some claimed that contributors had been undercompensated compared with the value they’d provided to the Sushi ecosystem. CTO Joseph Delong went as far as to propose a retrospective payment of 200,000 SUSHI (over $1 million) to each of the roughly 20 core contributors (excluding himself).

While it seems this was mainly a stunt to drive attention to long festering compensation issues, it roiled the SUSHI token price and led to a torrent of activity and competing proposals on the Sushiswap forum. This included several forum posts (some of which have been removed), culminating in a proposal to remove Joseph as CTO which was followed by his resignation.

Among the leadership failures Joseph called out, some apply broadly to many organizations within the DAO ecosystem:

Lack of clear authority to hire and fire core contributors, leading to decline in work quality and intractable personal conflicts

Failing to scale management functions within organization (eg hiring more PMs), which causes inefficiencies

Amid this upheaval, some of the investment funds with significant SUSHI holdings stepped in to propose new governance and organizational structure. While Sushi has been billed as a community led project free from VC influence, this could represent one of the positive benefits of involvement from fund companies, who have strong incentives to safeguard their investment through direct contributions and proposals.

The restructuring proposal seems to have a good deal of buy-in from the community and contributors, and includes the following elements to help Sushiswap improve organizational effectiveness and governance oversight:

While there is currently a bit of a power vacuum within Sushiswap core team, this episode may help put the DAO back on a path to success. By combining empowerment of the core team leadership with greater oversight, Sushi’s DAO structure could become a competitive advantage rather than an organizational handicap.

In Brief:

Tally’s Safeguard mechanism for multisig oversight receives OpenZeppelin audit:

Enso Finance launches vampire attack on 6 index protocols, with PieDAO responding by blacklisting contract addresses:

Gearbox Protocol begins DAO launch with radical decentralization:

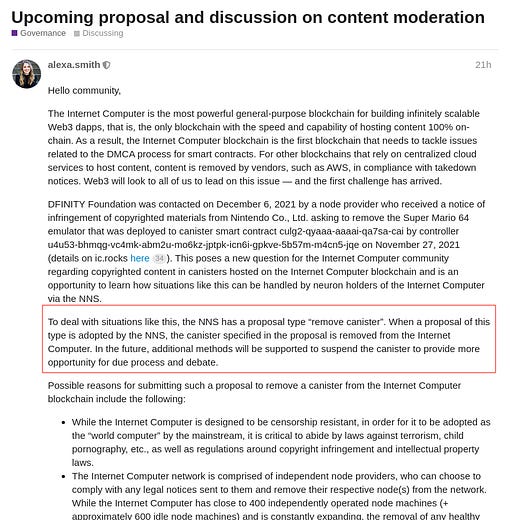

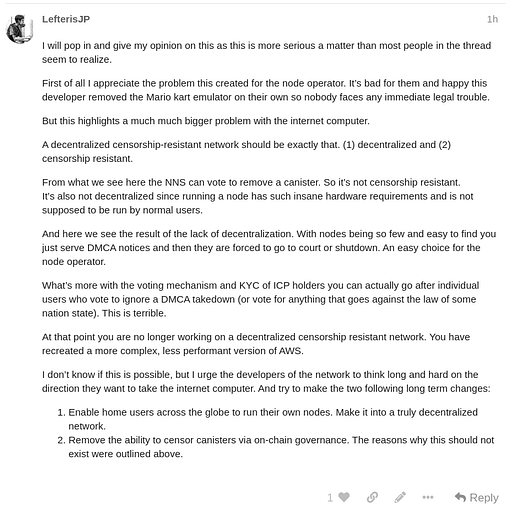

Dfinity’s on-chain governance considers DMCA takedown request:

Osmosis protocol considers Stargaze’s proposal for coinvestment into liquidity bootstrapping pool:

GFX Labs withdraws leadership of Fei Protocol - Rari Capital merger:

Terra’s Anchor protocol faces $30 million in faulty liquidations, potentially linked to critical security issue within core mint/burn mechanism:

Thanks for joining us for Tally Newsletter issue 55. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally