The Tally Newsletter, Issue 57

December 24, 2021

Welcome back for issue 57 of the Tally Newsletter, a publication focused on the DAO ecosystem. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover:

Consummation of Fei and Rari Capital’s Merger

Yam Finance Facing Possible Governance Attack

Plus brief updates from the wider ecosystem.

Fei and Rari Capital Merge Following Successful Governance Votes

TL;DR: Conversion of RGT to TRIBE is now open, and a “ragequit” mechanism to allow tribe to be converted to FEI stablecoin at a fixed price is live through

With successful governance votes from both the Fei and Rari communities, the FeiRari merger is finally taking effect. For token holders in the newly combined organization, there are some key actions and decisions to address in the coming days.

Holders can visit jointhetribe.xyz to begin the conversion process for RGT to TRIBE, but there’s no rush as currently the conversion process does not have a planned expiration date. However, Fei protocol is also offering TRIBE holders a “ragequit” option to redeem their tribe for $1.07 in FEI stablecoins, valid only for the next few days through December 26.

While the TRIBE price was below the redemption price up until the merger took effect, Fei’s team multisig quickly closed the gap by redeeming 10 million TRIBE tokens and immediately repurchasing 10.5 million TRIBE with the received FEI. This prompt action helped save the protocol from paying out roughly ~$500,000 in arbitrage profits unnecessarily.

Source: Twitter

According to Alex Kroger’s handy dune dashboard, slightly more than 6% of the fully diluted tribe supply has been redeemed through the ragequit function (roughly 12% of circulating supply). Providing easily accessible exit liquidity could help ease potential for internal tensions among those unhappy with the merger. For projects with significant liquid assets or equity, this ragequit mechanism has a lot of promise for making mergers and acquisitions more palatable to target communities.

Yam Finance Rallies Against Unannounced Governance Proposal

TL;DR: This incident demonstrates the need for vigilance, particularly for smaller projects with significant assets.

In an unexpected turn of events, Yam Finance recently saw an unannounced proposal submitted to their governance contract. While it may end up representing harmless spam, the proposal effects are unknown and several factors point to a potential governance attack seeking to strip the Yam treasury’s assets.

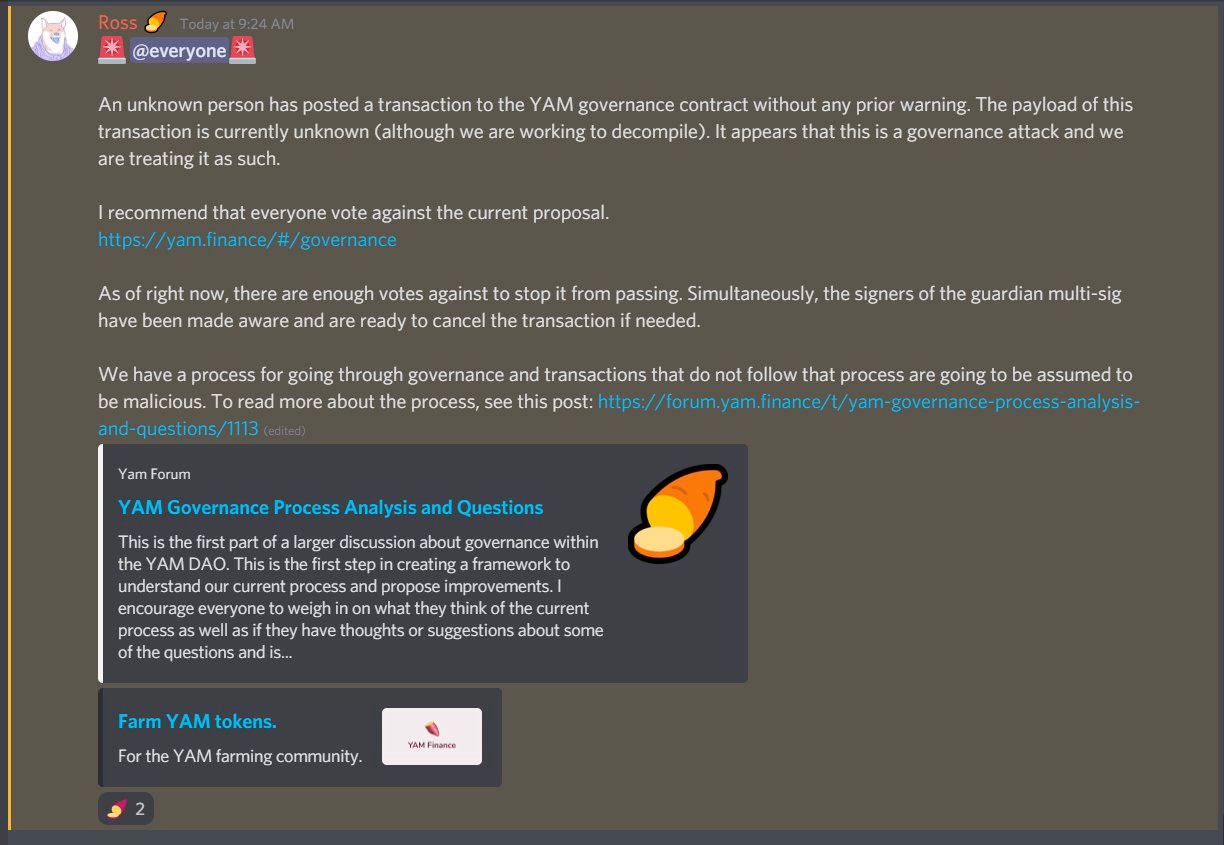

Source: Yam Discord

The offending proposal was input without any text explanation (simply repeating “merry christmas” to the limit of proposal text strings), but it does include an unknown execution payload that could transfer out assets or make unapproved changes to the YAM token. We can also see the proposer’s wallet was also funded through Tornado Cash, which is indicative of potential malicious intent.

Source: Yam Governance

Source: Etherscan

Swift reactions by large holders and the Yam team have largely neutralized the threat, with the proposal currently failing by a nearly 3 to 1 ratio. Yam also has a guardian multisig that may be able to cancel the transaction before execution in case it retakes the lead. But the brief spike in YAM price shows the relative ease with which this attack can be staged, and with a liquid treasury worth nearly twice Yam’s market capitalization, the incentive for takeovers or asset stipping are fairly strong.

Source: Coingecko

Existing YAM token holders can set up delegation or vote against this proposal on the Yam Finance site here.

In Brief:

Terra Ecosystem’s Mirror protocol faces possibly malicious self-dealing proposal:

Uniswap Labs team deploys Uniswap v3 to Polygon sidechain following successful governance vote:

Debt DAO seeks partnership with OlympusDAO to help launch their DAO financing protocol:

OpenZeppelin prevails in Compound’s auditing contract vote:

Thanks for joining us for Tally Newsletter issue 57. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally