The Tally Newsletter, Issue 59

January 7, 2022

Welcome back for issue 59 of the Tally Newsletter, offering our first DAO reports for 2022. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover Paladin and Bribe Protocols’ entry into the Curve wars, plus brief updates from around the DAO ecosystem.

Two New Projects Join the Competition for Curve Governance Influence

TL;DR: Paladin and Bribe Protocol plan to give Curve holders vote renting alternatives to the now dominant Convex protocol.

In the past 6 months, Convex protocol has quickly accumulated an overwhelming share of Curve governance power. While Yearn was the first DAO to accumulate Curve governance power through their liquid yveCRV wrapper for locked CRV tokens, their lack of inflationary rewards and yield farming hampered adoption. Convex on the other hand issues huge rewards to support price and liquidity of their cvxCRV wrapper which has resulted in them now holding nearly 50% of Curve voting power.

Source: Banteg / Dune Analytics

This has begun to become a self fulfilling flywheel. As Convex accumulates more CRV stake, this increases the CRV farming rewards earned by their yield farming vaults which further increases their lead. Even competing yield platforms like Yearn are now managing most of their Curve deposits through Convex to take advantage of these higher returns.

Convex has also benefited from primacy in another core Curve utility - gauge weight voting. Locked CRV holders vote biweekly to allocate new CRV inflation across various supported liquidity pools. Because these rewards are a crucial source of liquidity and steady state demand for stablecoins and other pegged asset issuers (like protocols for tokenizing Bitcoin), there is now a lively market for DAOs bribing veCRV holders to support specific pools. And Convex’s overwhelming share of voting power ensures they stand at the center of the market.

There’s widespread suspicion of bribery even from Curve’s beginning, as demonstrated by the huge rewards allocation for little known stablecoins such as Waves USDN for much of Curve’s first year in existence. But without transparent, on-chain mechanisms for bribery, these deals were shrouded in mystery and only available to the largest CRV holders.

Andre Cronje’s bribe.crv.finance helped democratize access to bribe revenues, and this was further expanded with Votium protocol’s system to bribe CVX holders directly for the veCRV votes under their control. Considering that taking part in CVX voting requires only a 3 month lockup, versus 4 years for veCRV, Convex gained an additional advantage as the most accessible way for DAOs to accumulate Curve voting power and influence gauge weights. Enter Bribe Protocol:

Bribe Protocol’s initial offering is very similar to Votium; users or DAOs can stake their governance tokens in Bribe, allowing the underlying voting power to be rented to the highest bidder. While this is initially targeted towards Convex and the so called “Curve wars”, as an ecosystem with a well established vote market, there are plans to extend this towards many other protocols as well.

In effect, Curve style vote bribing redirects some of the value of inflationary rewards back to the project’s governance token holders. For similar inflation based projects like Tokemak, this could help drive a positive feedback loop of higher token value, user incentives, and protocol usage. But the recent Mochi Inu fiasco at Curve finance also demonstrates some of the potential pitfalls, as vote buyers have little long term alignment with the success of the underlying project being bribed.

The example above of bribing a lender like Aave for asset listing also has high risk of incentive misalignment. If an unsuitable collateral asset is accepted, Aave holders would stand to lose far more than they might gain from bribe revenues. While one could argue that a majority of voting power would recognize this and reject the bribe offer, it creates a free rider problem where some voters need to act altruistically while others are free to extract revenue at their expense. As governance tokens are distributed by early investors and core teams, it may become more difficult to coordinate against negative incentives introduced through bribery.

While Paladin’s initial vote renting marketplace shares many similarities to Votium and Bribe protocols described above (supporting alternative governance tokens instead of locked CRV), their new Warden offering takes an alternative approach to veCRV marketing which may help rebalance power back in favor of individuals.

While Votium and Bribe protocol focus on gauge weight voting (which influences rewards allocations across pools and is sought after by stablecoin protocols), Paladin’s Warden will address another valuable element of veCRV - rewards boosting. Holding locked veCRV gives users the ability to earn up to 2.5x CRV rewards on their deposited liquidity, which is particularly valuable for large investors and yield aggregation projects like Yearn. For individual CRV holders who don’t have large amounts of stablecoins or other assets to invest into LP positions, this currently represents an opportunity cost of holding veCRV as an individual rather than through an aggregator like Convex.

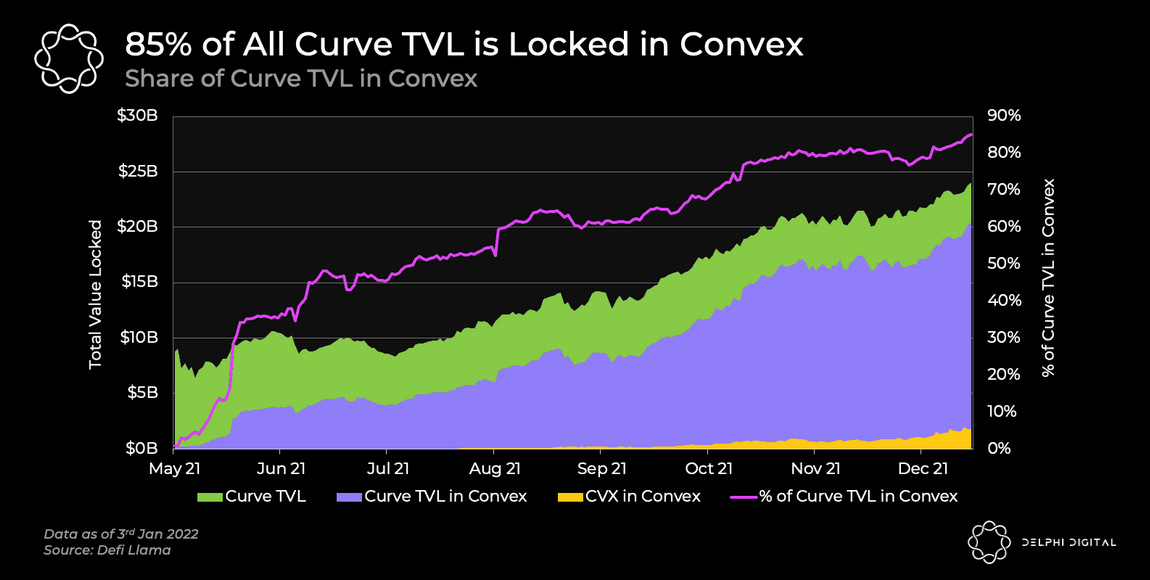

Source: Defillama / Delphi Digital

With their large boost capacity, Convex now accounts for over 90% of Curve LP deposits, which over time will further cement their control in Curve governance through accumulated protocol fees. Paladin’s Warden gives an alternative method for CRV holders to access this boost value, and may lead to a more even distribution of Curve governance power over time.

At a high level, bribing and vote trading mechanisms make voter extractable value (VEV) explicit and accessible, similar to Flashbots work on miner and validator extractible value (MEV). To support decentralization over the long term, it’s important that all token holders can extract VEV at a roughly equal rate, otherwise the additional earnings would lead to concentration of power. Bribe and Paladin protocols may help support this goal, but similar to the uproar last year over incentivized chain reorganizations, these vote trading systems may bring unwanted externalities as well.

In Brief:

MakerDAO considers assisting with recovering $10 million in lost DAI on Optimism

Reverie launches to pursue new approach to DAO governance activism:

GFX Labs submits plan for onboarding US Treasury bills as Maker collateral:

Voltz interest rate swap protocol requests license exception grant from Uniswap governance in exchange for a share of token supply

Thanks for joining us for Tally Newsletter issue 59. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally