The Tally Newsletter, Issue 62

January 28, 2022

Welcome back for issue 62 of the Tally Newsletter, a publication focused on defi and DAO governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover controversy surrounding the Wonderland crypto project and ripple effects throughout the DAO ecosystem.

Wonderland Treasury Manager Exposed as Former Fraudster

TL;DR: The exposure of Wonderland’s treasury manager Sifu’s history caused a run on the related MIM stablecoin that had secondary impacts across the ecosystem.

This past week proved the crypto space is stranger than fiction, with top defi projects embroiled in a scandal over anonymous contributor Sifu that is spiraling into a possible bank run. The controversy has centered on the Wonderland project where Sifu was a treasury manager, but has also impacted other projects run by founder Daniele Sestagalli and certain related protocols.

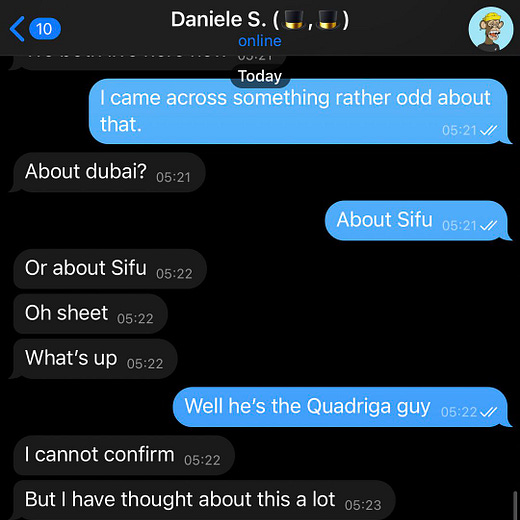

The panic started on Wednesday, when it was revealed that Sifu was convicted fraudster Michael Patryn, who is well known within the crypto space for their connection to the Quadriga exchange exit scam. Wonderland and MIM founder Daniele initially supported Patryn before backing away later under pressure.

This news broke just days after both Patryn and Daniele allowed personal borrowing positions against their project tokens to be liquidated, raising suspicions they were intentionally cashing out before negative market reactions.

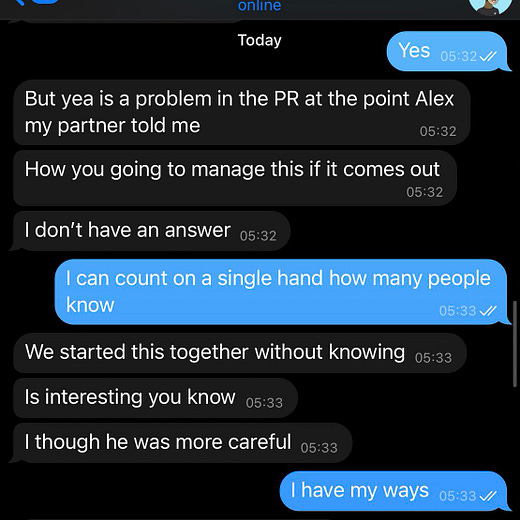

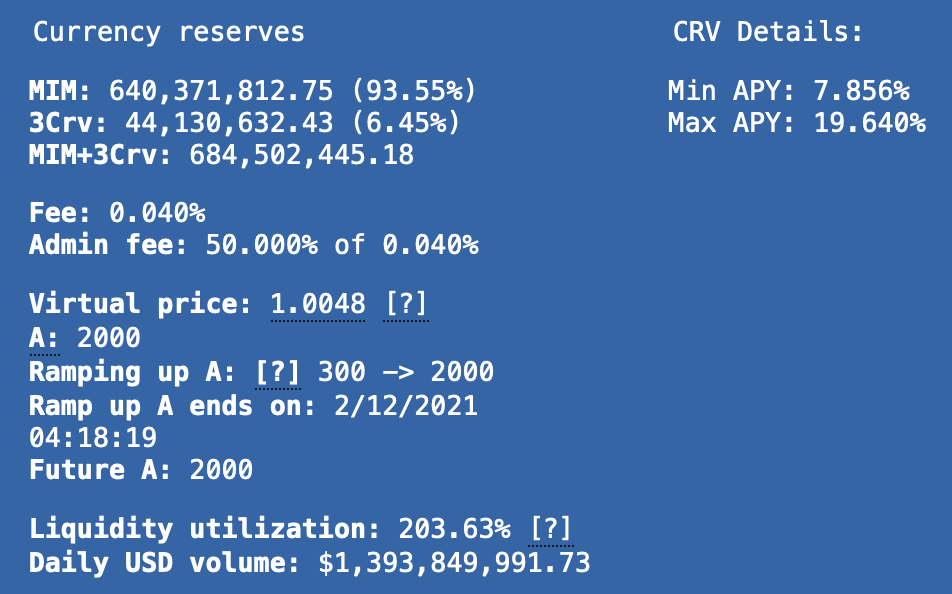

While Patryn only has direct multisig membership within the Wonderland treasury, with a governance vote in process to remove him, he is also involved in Daniele’s other projects which helped kick off a panic among MIM stablecoin holders. Sales and withdrawals left the primary Curve liquidity pool heavily unbalanced, with large holders unable to exit without significant losses.

Source: Curve Finance

Certain other stablecoin swap projects also faced disruption, with the Avalanche based Platypus hastily delisting MIM to protect deposits.

While MIM is a fully collateralized, debt backed stablecoin similar to Maker’s DAI, it faces certain weaknesses that may make it tough to return to peg. Unlike with Maker’s vaults, Abracadabra’s borrowing facilities are set up with immutable parameters, meaning it’s impossible to raise borrowing rates to incentivize repayment. This leaves Abracadabra without any direct levers to help reduce supply, other than curtailing new MIM issuance.

The stresses on MIM have laid bare some of the compounding risks within the highly integrated defi ecosystem. While it has no direct involvement with Patryn, the Terra ecosystem faced difficulties, with significant collateral usage (over $1 billion of UST collateral at peak) and shared liquidity pools (hundreds of millions in MIM-UST pool on Curve) partially transmitting the depeg event from MIM to UST. While UST has regained its peg, the extra market stress may have contributed to current downtime on Terra’s ETHAnchor lending integration.

With Wonderland trading below the fair value of treasury assets, there is also a possibility that a dissolution proposal would release additional reserves of MIM onto the market, putting further pressure on the peg.

The concerns about anonymous project contributors apply to many other projects, and could lead to a wholesale reassessment of the needs for decentralized governance and treasury management. Assuming dissolution is ruled out, any successor Wonderland team would face an uphill battle to regain trust and guarantee safety of funds. And other similarly situated projects including OlympusDAO (with a primarily anonymous set of multisig signers) may also face pressure to improve security with direct control by token holders.

Crucially, higher security doesn’t need to come at the expense of agility; projects like Fei demonstrate how funds can be split between full DAO control (Fei uses a Compound/OZ style governor contract and timelock) and less restrictive operation accounts (such as Fei’s community multisig responsible for rewards and ops spending). This allows for safely storing the majority of funds, and reducing the amount of trust token holders must place in core contributors.

In Brief:

Tally News

The Tally team will be at EthDenver from Feb 17 through Feb 20. We look forward to seeing you there!

Our DAO Challenges report is now available! Check it out here

Candle and Silo are among several new projects listed on the Tally voting and governance app

Cosmos Ecosystem

Several protocols receive suspicious funding requests, stress testing communities’ treasury management:

Osmosis and Sifchain exchange projects face conflict over bridge strategy:

EVM Ecosystems

Fei Protocol releases details on Turbo, a new product to expand Fei issuance and liquidity while offering returns to :

Binance lending project Qubit taunted by hacker after $80 million exploit:

Trading firm mgnr takes fire for extractive farming practices on Maple Finance:

Thanks for joining us for Tally Newsletter issue 62. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally