The Tally Newsletter, Issue 66

March 11, 2022

Welcome back for issue 66 of the Tally Newsletter, a publication focused on defi and DAO governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover Cosmos based Juno Network voting on a historic proposal to confiscate funds from an address, mirroring the response to Ethereum’s DAO hack.

Plus brief updates from the DAO ecosystem!

Juno Chain Votes on Historic Proposal to Confiscate Funds

TL;DR: After the initial airdrop distribution was gamed by a single party to evade per address limits, the Juno community is considering removing most of their funds retroactively.

The Cosmos SDK based Juno Network is currently voting on a historic and high stakes proposal that could have lasting impact on their chain and community. We dig into the details of what could amount to Cosmos’ “The DAO” incident below.

First, some background. Cosmos chains offer programmability and enable complex coordination mechanisms similar to Ethereum. Juno Network in particular leads the way here, being the first chain to enable CosmWasm smart contracts which can be used to implement anything from tokens to decentralized exchanges to DAOs. We’ve already seen a growing wave of Juno based DAOs, primarily launched on the upstart DAODAO platform (not to be confused with the recently launched “DAO, DAO” fundraising scheme launching on the controversial DeSo blockchain).

But unlike Ethereum and most other smart contract chains to date, Cosmos SDK chains are themselves a DAO of sorts. On-chain governance gives token stakers wide ranging powers over the platform, including the ability to alter arbitrary balances or make other extra-protocol changes. Where Ethereum needed to coordinate via rough consensus and off chain governance to rectify the DAO hack incident, in Juno’s case this could be solved through a routine governance proposal.

This is exactly what we’re seeing now, with Proposal 16 attempting to remove funds from a large holder who seems to have sybil attacked the initial JUNO airdrop. While Juno’s airdrop included a 50,000 ATOM maximum cap to help improve network decentralization, shortly after genesis the offending user consolidated proceeds from 52 wallets into a single account - indicating a single entity had split funds among many different wallets. This now presents serious risks to the project, with the 3 million JUNO tokens (worth $120 million at time of writing) able to drain existing liquidity pools and also over 50% of the voting power required to meet quorum for governance proposals.

Crypto pseudonymity makes attribution difficult, but on-chain records seem to indicate a connection with an old Cosmos based MLM scheme (which could help explain the high number of wallets involved), as well as relations with a particular validator.

At present, the vote seems to be falling in favor of confiscating the majority of funds and sending them back to the community pool, reducing the wallets balance back to the intended limit. But not everyone is happy with this outcome, as it contradicts widely held views that transactions and balances should be largely self sovereign and immutable. It also remains possible (although unlikely) that this was not a sybil attack but represents pooled balances from multiple users or even OTC trading activity.

This also brings up interesting questions about “double jeopardy”, as a similar proposal for confiscation was rejected shortly after the chain’s genesis (proposal 4). Nothing in Cosmos code can prevent resubmitted proposals, funds confiscation, or other controversial governance measures. This indicates social consensus on ground rules and legitimate scope of chain governance - among both token holders and validators - will play an important role in the Cosmos ecosystem going forward.

And the likely outcome of removing funds also opens the way to potential fork based governance. The Juno whale owner and other disaffected parties can respond by launching a new chain that restores the revoked balances from the Juno chain, while also potentially burning balances of those voting for funds removal. This creates interesting dynamics where the dominant strategy for voters is abstention or voting against, unless there is a strong and pressing need to move forward with the action on the original chain; this could serve as a critical counterweight to governance overreach on Cosmos chains.

This episode could also force future projects away from the popular Cosmos ecosystem trend of “fairdrops” that are partially weighted per wallet, rather than strictly linear based on proof of capital. And even the concept of airdrops may face challenges, as they provide limited utility for the underlying network.

Additional information about the entity is still being unearthed, which may also sway the results before voting closes on March 15.

In brief:

Ethereum Ecosystem:

Coinlist to support Snapshot voting from their exchange accounts:

Ethereum Gas Limit (EGL) project closed over concerns about negative Ethereum governance impacts:

Polygon recovers from unscheduled downtime:

Convex Finance sees mass token unlock due to bug in rewards distribution mechanism:

Cosmos Ecosystem:

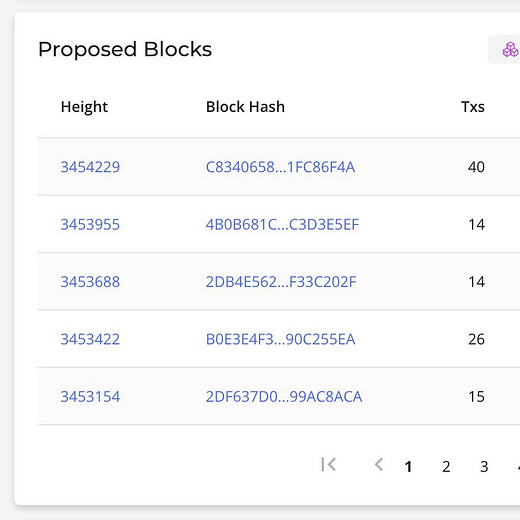

Osmosis sees a significant share of empty (0 transaction) blocks due to lack of coordination between wallets and validators:

Arca and Polychain face criticism over Anchor proposal for deposit limits (which could be circumvented by splitting wallets), with additional concern over suspicious trading activity by the proposer wallet:

Other Ecosystems:

New project (DAO,DAO) draws skepticism from the wider DAO community:

Thanks for joining us for Tally Newsletter issue 66. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@withtally.com

Best,

Nate, Tally