The Tally Newsletter, Issue 69

April 15, 2022

Welcome back for issue 69 of the Tally Newsletter, a publication focused on defi and DAO governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

This week we cover recent developments in the algorithmic stablecoin space:

Terra and Frax Join Forces in 4pool Incentive Push

Waves Protocol’s USDN Stablecoin Recovers After Loss of Peg

Ichi Stablecoins Face Serious Pressure After Lending Pool Insolvency

Plus brief updates from Tally and the DAO ecosystem!

Terra and Frax Propose Creating Curve 4pool with UST, FRAX, USDC, and USDT

TL;DR: The move will help concentrate incentives from both protocols into a single pool, and also consciously excludes DAI to limit growth of a main competitor.

Terra and Frax Finance dominated the defi news cycle over the past several weeks with a partnership announcement seeking to dominate stablecoin liquidity across Ethereum and other EVM chains.

How does Terra UST work?

Terra protocol supports the UST stablecoin using an algorithmic stabilization mechanism. UST can be swapped for a $1 equivalent value of Terra’s native token LUNA at the protocol level (with additional swap fees and time base slippage added to mitigate oracle risk). This creates arbitrage incentives to maintain price stability; when UST is above $1, users can trade $1 of LUNA for UST and sell on the market to earn a risk free profit, and conversely users can by UST and then swap for $1 worth of LUNA when below peg.

In normal times this is sufficient to stabilize the price of UST, but there is a potential “death spiral” risk if a large share of UST holders decide to exit the Terra ecosystem in a short period of time. In this case, persistent selling pressure would force UST below the peg, which incentivizes arbitrageurs to swap UST to LUNA and market sell for risk free profit. This would put downward pressure on LUNA price, requiring an ever greater amount of LUNA to be minted in exchange for each UST token redeemed. In a worst case scenario, there would be insufficient LUNA demand to return UST to peg, and remaining holders of UST would face a loss. The potential late redeemers to face total losses creates a bank run dynamic during market crashes.

Terra has recently sought to address this through formation of the Luna Foundation Guard, a Singapore based entity focused on maintaining UST’s peg through reserves of external collateral. Initially the reserve focused on Bitcoin, but have also expanded to hold significant quantities of USDT and USDC stablecoins as well as Avalanche’s native token AVAX. While these reserves have grown significantly in the past three months, they total below 20% of outstanding UST with the system still primarily relying on algorithmic backing from LUNA.

How does FRAX work?

Frax bears similarities in design to Terra, but as indicated in the name it relies on “fractional algorithmic” backing rather than pure algo stabilization. In practice, this means the majority of FRAX is backed by investments in traditional stablecoins like USDC; funds are typically lent or deposited in 3rd party defi protocols to earn yield for the protocol. FRAX peg is maintained through arbitrage incentives like UST, but typically around 85% of each buy or sell is redeemed in USDC or another stablecoin, which reduces in potential death spiral risk if FRAX were to face a surge in redemptions (people trading FRAX for alternative stablecoins).

Source: Frax Finance site

While FRAX’s algorithmic backing rate is nominally only 14% (with 86% collateralized by external investments), the inclusion of FRAX based Curve liquidity pools (listed as Curve AMOs) as ⅔ of collateral creates significant intrinsic leverage. If FRAX were to trade below the peg, the vast majority of the Curve pool would be made up of FRAX tokens rather than external stablecoins, which shifts FRAX’s effective backing away from collateralized assets towards increasing algorithmic backing. But even with this effect included, FRAX has much less reliance on algorithmic backing than its peers.

Recent events

Currently, most stablecoin liquidity on Ethereum is held within Curve “meta-pools”, which link a single stablecoin with the primary Curve 3pool consisting of USDC, USDT, and DAI. Both UST and FRAX currently focus their liquidity around these metapools. But while these pools serve their purpose reasonably well (maintaining liquidity and price stability), they have a few strategic drawbacks.

First, using a metapool for liquidity makes it impossible for your asset to serve as a base reserve asset for other stablecoin liquidity pools. And beyond this, utilizing the 3pool for base liquidity creates steady state demand for DAI, which both Frax and Terra consider to be a primary competitor.

Terra and Frax also raised the prospect of increasing efficiency of their existing Convex voting and bribe activity (both projects are large CVX holders and pay incentives for bribes). But this supposed efficiency is dubious, due to the fact that each stablecoin will make up only 25% of the proposed 4pool compared with 50% of their individual metapools; while they would be effectively providing joint incentives, the concentration of rewards on each of their individual stablecoins would be the same as before.

These projects hope to become the preferred base liquidity pool for 3rd party stablecoins to link with. If the 4pool is able to compete with or supplant the existing 3pool, many additional projects (eg. Abracadabra, Jpegd, and others) could passively subsidize UST and FRAX demand and reduce these protocols’ own liquidity costs.

The greatest challenge for this vision to play out is users’ and projects’ perception of relative risk between DAI, FRAX, and UST. DAI’s overcollateralized backing, decentralized governance mechanisms, and long track record of solvency make it a relatively low risk option among decentralized stablecoins. FRAX is primarily backed with fiat stablecoins which reduces solvency risk, but has partial algorithmic backing and is also exposed to smart contract risk through various integrations. And UST is perhaps the most risky of the 3 assets, with less than 20% backing of circulating tokens with volatile BTC and AVAX reserves making it vulnerable to a bank run.

If users demand a higher rate of return to hold Curve LPs paired with the 4pool versus the 3pool, projects should only be willing to use a 4pool metapool with additional incentives from Terra and Frax. This would reduce or eliminate the passive liquidity benefits of serving as a base metapool on Curve. But the 4pool’s competitive prospects may be boosted by Frax and Terra’s significant partnership and business development efforts, with projects including Redacted Cartel (large CVX and CRV holder), Tokemak (liquidity management protocol), and Alchemix (credit protocol focused on self-repaying loans) showing support.

Curve governance has already indicated support for the 4pool (as well as a slimmed down USDC-USDT 2pool) in a snapshot poll, so launch is likely in the coming weeks. From there attention will shift to liquidity flows between competing base pools, as well as decisions by third party stablecoin projects on where to focus their own incentives. Regardless of the 4pool’s direct impact on stablecoin liquidity, Frax and Terra have clearly demonstrated their influence across top defi protocols.

Waves Protocol’s USDN Stablecoin Recovers After Losing Peg

TL;DR: A sudden buildup of leverage within the Waves ecosystem triggered a bank run, and while USDN is recovering the Vires money market protocol remains under pressure.

While algorithmic and undercollateralized stablecoins have been gaining significant traction (eg. Terra and Frax joint initiative discussed above), we’ve also seen recent examples of their fragility. The USDN stablecoin, based on the Waves blockchain, dipped as low as $0.70 last week before recovering to around $0.98 at present.

Source: Coingecko USDN

How does USDN work?

USDN uses an algorithmic backing mechanism on top of the Waves blockchain’s native token. While this is somewhat similar to Terra’s UST, the specific backing mechanisms differ. USDN includes a separate equity token, NSBT, to recapitalize the system by purchasing additional WAVES whenever backing falls too low.

USDN earns a base yield based upon the WAVES native staking rewards rate and current WAVES to USDN collateral ratio, which serves as an additional demand incentive. But this is somewhat pro-cyclical, as declining WAVES price causes both declining collateralization ratio and USDN yield (which may lead some USDN holders to swap for other stablecoins during a market drop).

Recent events

Both the native WAVES token and USDN stablecoin had seen a spectacular spurt of growth in the past two months. But upon closer inspection, the surge in activity was largely inorganic.

Vires Finance, a Compound style lending protocol built on the Waves blockchain, played a key role in both the run up and crash of the WAVES and USDN tokens in the past month. Large users (potentially team members) executed a strategy of convering WAVES to USDN, depositing to Vires, borrowing external stablecoins like USDC or USDT, and then swapping back into WAVES. This leveraged buying pressure forced WAVES price up, which in turn increased USDN yield and demand through the native staking mechanism. Crucially, the Vires market considered the USDN price to be fixed to $1, meaning that this strategy was free from liquidation risk.

At the beginning of April, the leverage fueled rally got overextended and public opinion began to turn against USDN due to some high visibility critiques. As sentiment turned negative, market maker Alameda became embroiled in the drama when it emerged that they had been borrowing WAVES tokens from Vires (likely as part of a delta neutral strategy rather than outright short position) and the Waves blockchain founder advocated to forcibly liquidate their position.

In the following week since the initial depeg event, Alameda has closed their borrowing position and USDN has largely returned to peg. But while on the surface conditions have improved, the pent up leverage present on Vires remains with over $500 million in outstanding USDC and USDT loans (primarily against USDN collateral).

Source: Vires Finance

The presence of 100% yields for over a week, without new deposits or loan repayments freeing up liquidity, indicates low market confidence in Vires’ solvency. If the loans on Vires were to be forcibly unwound today, this would quickly deplete available liquidity in Curve and other decentralized exchanges and could kick off another bank run on the Waves protocol.

Ichi Protocol Faces Serious Test Due to Insolvent Lending Pool

TL;DR: Excessive leverage on the protocol’s native ICHI token resulted in a wave of insolvent loans and negative impact on linked algorithmic stablecoins.

Ichi protocol was top of mind over the past week due to serious disruption of their lending pool based on Rari Capital’s Fuse protocol. While the pool was not directly involved in Ichi protocol collateralization mechanisms, it kicked off a general market panic that triggered loss of peg for Ichi’s flagship oneUNI stablecoin.

Source: Coingecko oneUNI

How do Ichi stablecoins work?

Ichi protocol allows users to create “branded” stablecoins such as oneUNI (based on the Uniswap UNI token) or oneBTC (based on WBTC). Similar to FRAX, Ichi stablecoins use fractional algorithmic backing and arbitrage incentives to maintain peg; when above $1, users can mint stablecoins with a mix of USDC and the given stablecoins base asset (eg. UNI for oneUNI), while redemptions below peg are backstopped 100% with USDC.

This ensures tight peg in normal conditions and allows for a stablecoin’s reserves to gain from upside in the base token. But if a rush of withdrawal requests and exits correspond with price falls in the base token, there may be insufficient reserves for all stablecoin holders to withdraw $1; this creates negative bank run dynamics where users rush to be first to withdraw their funds if they fear insufficient collateralization.

Recent events

Initial evidence indicates the Ichi team or other large token holders may have fallen into similar lending pool manipulation schemes as occurred with the Waves and Vires protocols discussed above.

One of Ichi’s products is so called “angel vaults”, which are automated Uniswap v3 strategies creating buy walls just below the current market price of a given token. While this can help build price support in the short term, it was used excessively to boost ICHI’s token price in the lead up to the market crash and lending pool insolvency.

Looking at ICHI’s price chart, we can observe several ranges where the buy wall on ICHI was progressively moved up (first to $70, then to $130), allowing users of the fuse pool to borrow assets based on inflated collateral values. When market conditions turned, selling pressure was able to break through the buy was and cause cascading liquidations. This was exacerbated by money for the buy wall being funded through loans against the ICHI token itself.

With the fuse pool allowing over 5x leverage on ICHI token collateral, many loans quickly became insolvent as their collateral was no longer worth more than the borrowed amount. In hindsight, allowing such high leverage against the relatively illiquid ICHI token was a recipe for disaster.

As a permissionless lending market protocol, Rari Capital doesn’t control risk parameters or backstop default risk of pools created by third party protocols. This means the recovery process (including liquidation of remaining loans and potential compensation for lenders) relies entirely on Ichi protocol. But so far the outlook for investors in the fuse pool does not look good, with the Ichi team removing liquidation incentive seemingly with the intent to support ICHI price at the expense of users who cannot withdraw funds from the pool.

The Ichi fuse pool was oneUNI stablecoin’s largest supply sink (with borrowing fees as well as ICHI liquidity incentives), so the pool’s collapse led to a severe demand shock. With the stablecoin’s backing already falling due to decline in the price of UNI, there was insufficient USDC to meet all redemption requests and the stablecoin broke below peg.

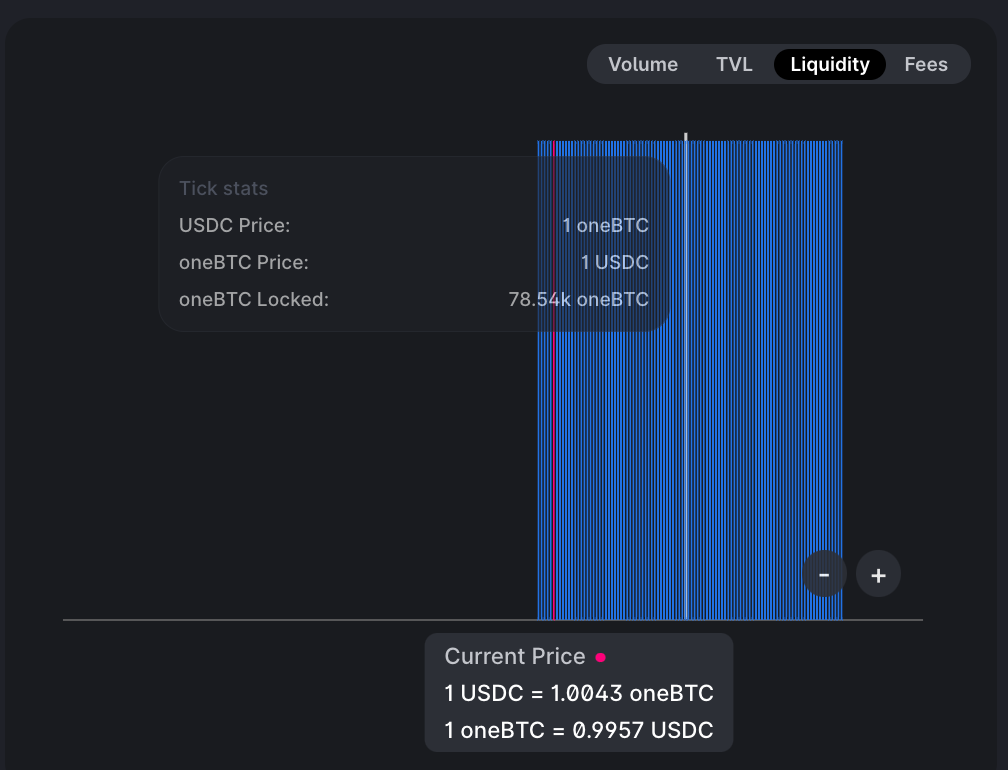

While exact backing percentage and potential haircuts are still up in the air, oneUNI holders can likely only expect to see a fraction of their initial investment. Other Ichi stablecoins such as oneBTC have remained stable due to better treasury performance, but they remain broadly vulnerable to similar price and demand risks experienced by oneUNI. Initial signs of stress are already appearing in the oneBTC liquidity pool which is heavily unbalanced with minimal USDC exit liquidity remaining.

Source: Uniswap info

In Brief:

Tally News

Tally Content Guild seeks DAO operators and experts to help share best practices for building decentralized organizations:

Check out the latest post on the Tally blog with founder Dennison Bertram exploring the DAO contributor experience and key challenges:

Ethereum Ecosystem

Compound votes on reduced MKR borrowing limit to mitigate governance risk to MakerDAO, with proposal to Aave governance to follow:

Lido and Curve receive proposals to contribute tokens to core Ethereum development fund, similar proposal is rejected by Compound:

Uniswap executed first cross chain governance proposal (to Polygon) without use of trusted party or multisig:

Cosmos Ecosystem

Osmosis offers new interface for interacting with briged assets that have not yet been approved by OSMO governance:

Juno faces unscheduled downtime caused by targeted consensus exploit:

Osmosis proposal 191 would directly incentivize validator decentralization and “stake flattening”:

Thanks for joining us for Tally Newsletter issue 69. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@tally.xyz

Best,

Nate, Tally