The Tally Newsletter, Issue 73

July 1, 2022

Welcome back for issue 73 of the Tally Newsletter, a publication focused on defi and DAO governance. We’ll keep you updated on key proposals, procedural changes, newly launched voting systems, shifting power dynamics, and anything else you need to know to be an informed citizen.

In this issue we catch up on recent developments in MakerDAO governance, which is currently engaged in spirited debate around the future evolution of governance and priorities of the protocol.

Note: I’m currently a contributor and delegate within the Maker protocol. This post represents my personal views, and does not necessarily align with other DAO contributors, delegators, community members, or MKR holders. Readers are encouraged to seek out primary sources and form their own informed opinion.

MakerDAO Struggled to Agree on Future Direction

TL;DR: Amid record setting voter participation, the Maker community is debating plans to address key weaknesses in the existing governance landscape while maintaining the core values of the protocol.

The past week has seen unprecedented levels of voter participation within Maker governance, amid controversy over conflicting visions for protocol governance. This has created conditions similar to a proxy battle, with opposing factions engaging usually inactive stakeholders and competing over proposals that are at first glance unrelated to the main points of contention.

To fully understand Maker governance, we must review some of Maker’s recent history and challenges that led to the current conflict.

The Purple Pill

While this is ancient history in crypto terms, Maker faced a previous governance conflict that came to a head back in 2019, now known as the “Purple Pill”. There were essentially two separate organizations working together to develop the protocol, the main Maker company and Dapphub (a separate entity led by Nikolai Mushegian). Both were funded by the Maker development fund, an allocation of MKR tokens created when the project launched which was controlled via a multisig and overlaid Maker Ecosystem Growth Foundation (MEGF).

While both teams played a key role in developing the core single collateral DAI (SCD) and multi collateral DAI (MCD) systems, they developed divergent views on the ideal end state of the protocol and proper forms of project governance. As internal tensions grew, Rune (Maker’s original founder and primary project leader) delivered an ultimatum: red pill or blue pill. The red pill (predominantly based in Rune’s part of the organization) represented belief in integrating Maker and DAI into the broader financial system and real world assets (RWAs). The blue pill (predominantly aligned with Nikolai) on the other hand advocated for a more “pure” system based on only crypto native collateral assets and mechanism design to support stability. Rune’s ultimatum would force out “blue pill” adherents after the completion of the initial MCD spec.

Amid this internal conflict, a group of contributors including many members of the MEGF board of directors attempted to forge a compromise between the two sides, referred to as the “purple pill”. But when Rune discovered this group was coordinating privately, he forced out the involved board members and assumed full control over the project and dev fund. Many of the contributors aligned with the blue pill faction left the project, with some going on to work on alternative stablecoin projects that more closely aligned with the focus on trustless collateral (eg. Ashleigh Schap contributed to Liquity’s LUSD while Nikolai contributed to Reflexer’s RAI).

Monetalis and the LOVE (Lending Oversight) Core Unit

Fast forward to earlier this year. The Maker community had mostly aligned on the need to onboard RWAs and other off chain collaterals to help DAI scale and meet user demand. This reliance on off chain assets had been initially forced onto the protocol in the aftermath of the March 2020 crypto crash, when USDC was onboarded via emergency vote to help stem a liquidity crisis. But this integration steadily increased with alternative stablecoins and the development of “peg stability modules” to more closely link DAI price with USD. A key issue with these stablecoin integrations was that, while they helped ensure DAI liquidity and prevent deviation from the peg, they didn’t earn any revenues to counterbalance increased credit and centralization risk.

This put the focus firmly on lending based RWAs with the capacity to earn revenue, and particularly towards more scalable arranger type deals (where Maker’s counterparty is more akin to a credit fund than a single asset originator). But this renewed RWA focus got off to a rough start.

Monetalis, a startup credit fund, was one of the first arrangers to apply for a Maker credit line, initially requesting 500 million DAI in capacity to fund UK based sustainable business lending. But their application failed to gain support or a positive recommendation for onboarding from either the main Real World Finance (RWF) core unit, or the Lending Oversight (LOVE) core unit, due to significant risk, lack of track record of underwriting performance, and off-market pricing.

Complicating matters further, Rune and many other Maker OGs made private investments into Monetalis equity. While this was well intentioned (wanting to help kickstart RWA onboarding in Maker), it presented the appearance of conflicts of interest that made objective review of the proposal more difficult. This concern was only reinforced by several subsequent proposals to force through Monetalis approval, including measures that would have explicitly blocked all other collaterals until Monetalis was onboarded. This also added to concerns about undue influence on the credit review process, as Rune had recently forced out the previous RWF core unit facilitator and made comments undermining the risk reviewers’ integrity.

Aggressive Growth Strategy

While the above deliberations on real world assets were ongoing, the protocol was beginning to stagnate on several fronts. Prospects for onboarding crypto native collateral were hamstrung by lack of borrowing demand and suitably liquid assets. Planned L2 rollup integrations were continuing apace but still required more time before they were ready. And increasing governance complexity was slowly reducing protocol agility.

In response, contributors across several core unit teams proposed a multi part plan to streamline operational planning, alongside raising capital to allow the protocol to take greater lending risks and pursue more revenue opportunities. The theory was that higher capital buffers would allow Maker to onboard more risky, higher yielding assets without increasing existential risk to DAI holders.

While this would align somewhat with the Monetalis deal above by increasing the DAO’s risk tolerance with respect to RWAs, it also seems to have triggered strong resistance from Rune and certain other community members. In some ways, there were clear parallels with the earlier “purple pill” conflict: private coordination of contributors, with the prospect of altering the organization’s capital structure and balance of voting power (in this case through capital raises with VCs).

This seems to have partially motivated Rune’s Endgame Plan proposal, which specifically discourages private coordination between separate core units and contributors.

Rune’s Endgame Plan

Roughly a month ago, Rune began releasing and advocating for a revamped plan for Maker governance and protocol development. While the plan has many components and is fairly complex, it seems to be driven by the following primary motivations:

Most of Maker governance deliberation is focused on budget management, but the current governance framework is not well suited to the task

Insufficient budget discipline and accountability of workforce to MKR token holders

Perceived risk of contributors coordinating against the interest of token holders

Voter apathy and resignation, partly driven by increasing protocol complexity

One of the most important changes to governance is the formation of decentralized voter committees (DVCs), which gather together token holders who align on a particular vision for MakerDAO. The DVCs would coordinate on voting and delegation activity, help define and prioritize the protocol’s focus objectives, elect “executive delegates” (top delegates given “soft job security” and increased compensation, in exchange for explicit requirements of transparency and attendance to voter committee meetings), and manage budget allocations. In exchange for this increased engagement, MKR holders participating in recognized DVCs would earn incentives of vesting MKR tokens.

While this has the potential to significantly improve voter engagement and realign the protocol more closely with token holders, this is not without risk. Rune currently leads the only active DVC, which is focused on enacting his Endgame Plan proposal. As the primary source of delegation and active voting power within the DAO, he already has significant influence which stands to increase if DVCs gain a formal role in governance.

In particular, DVCs could increase the following centralization risks:

DVC leaders can restrict access and membership, which is meant to ensure groups stay aligned and productive but could marginalize some MKR holders

A dominant DVC could potentially vote or delegate strategically to control key appointments, disbursement of delegate compensation, budgeting, and even recognition of competing DVCs for voter incentives (eg. spread votes to ensure as many of their chosen candidates gain positions)

Control of delegate and voter payouts could disincentivize participation in non-dominant DVCs

Readers are encouraged to review the Endgame Plan posts (and summary posts / meeting recordings) to learn about other key elements of the plan including:

Spinning out core units into semi-independent meta DAOs, to try to make relationships with MakerDAO easier to manage (and potentially more fungible or easier to replace with competing service providers)

Explicitly measuring workforce performance against priorities set by MKR holders

Budget allocation processes and incentives

Votes

Internal tensions on a range of issues, including workforce accountability and the relative merits of the Aggressive Growth Strategy vs the Endgame Plan, came to a head in last week’s voting session.

While participation was high across the board, the vote to approve or reject the Lending Oversight core unit was a focal point with the highest level of participation of any MakerDAO vote so far.

In the lead up to the vote, there were some concerns about undue influence of VCs, with some even going so far to suggest the participation of typically inactive voters represented a governance attack. There was also significant borrowing activity on Aave’s lending market, with borrowed MKR used to participate in key poll votes.

Initially the votes for the LOVE core unit onboarding and aggressive growth strategy seemed to have a slim lead, but rare voting participation from Maker cofounder Nikolai as well as last minute redelegations by Rune swung the vote convincingly against both measures.

While there was clearly substantive disagreements from Rune and others towards these proposals, it’s impossible to discount the appearance of possible retaliation for prior RWA reviews or fund raising efforts.

Hasu’s Simple MakerDAO Plan

Following on from last week’s votes, Hasu (the most prominent non-Rune backed delegate) proposed an alternative governance redesign plan coordinated with many of the contributors involved in the failed Aggressive Growth Strategy.

Called the Simple MakerDAO proposal, Hasu’s plan would install a council of representatives elected for specific terms to oversee the decentralized workforce (similar to a board of directors, but without any executive authority to pass proposals without MKR holder approval). The council structure would support greater compensation and job security (similar to the Endgame Plan’s executive delegates), and would be empowered to align teams and budgets around a coherent high level strategy.

While this plan has the benefit of being relatively simpler than the Endgame plan, it has drawn significant criticisms around centralization of decision making power, and the prospect of replicating negative corporate structures from tradfi. Both plans are being considered by the community concurrently with spirited debate ongoing in the Maker forum.

Source: Dirt Roads Newsletter

If recent votes are anything to go by, we may see continued governance conflict as the community and MKR holders determine the future structure of DAO governance.

In Brief:

Tally News

Last week’s DAO NYC conference gathered hundreds of DAO contributors and stakeholders together for forthright discussions on the past, present, and future of decentralized governance:

Ethereum Ecosystem

Compound announces revamped v3 of their lending protocol, along with intention to pursue cross chain deployments:

Aave adds sAVAX (liquid staked AVAX) to Avalanche market, but should not be vulnerable to risks similar to stETH as sAVAX is already redeemable:

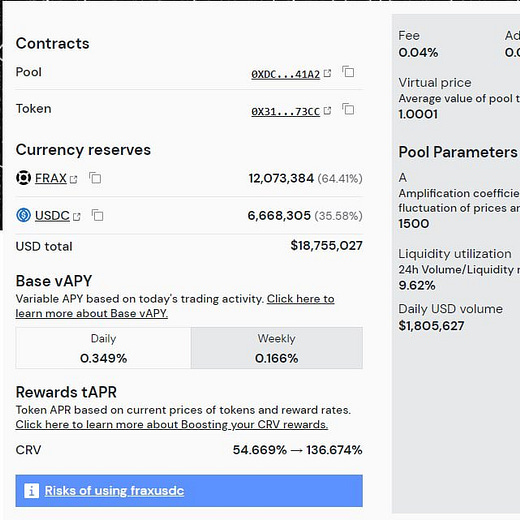

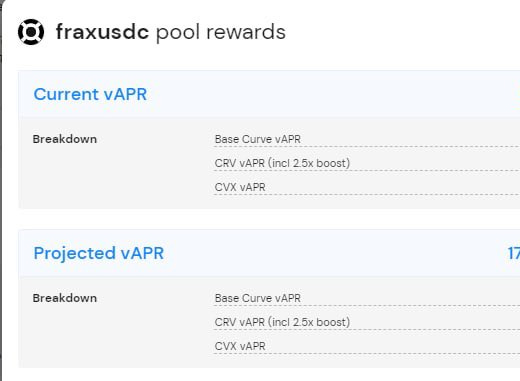

Frax partners with Curve to launch FRAX-USDC pool (reducing Tether exposure while potentially gaining more utility with metapools), and also proposes to be whitelisted for participation in CurveDAO governance:

Euler Finance sees attempted manipulation of gauge rewards system, likely requiring governance response:

Other Ecosystems

Cosmos Hub proposal 72, intended to fund P2P Validator’s efforts to launch a chain using ATOM interchain security, faces very close vote:

Solana based Solend lending protocol targets dangerous whale position for special OTC liquidation, but eventually reverses course after community resistance and the counterparty reducing position risk:

Thanks for joining us for Tally Newsletter issue 73. Be sure to check out the Tally governance app and join us on Discord for the latest updates!

Anything we missed? New developments or protocols you’d like to see covered? Drop us a line at newsletter@tally.xyz

Best,

Nate, Tally